Primary Ovarian Insufficiency Treatment

Primary Ovarian Insufficiency TreatmentPrimary Ovarian Insufficiency Treatment 2025 to Grow at 6.6 CAGR with 735.7 million Market Size: Analysis and Forecasts 2033

Primary Ovarian Insufficiency Treatment by Type (Hormone Replacement Therapy (HRT), Calcium and Vitamin D Supplements, In Vitro Fertilization (IVF), Stem Cell Therapy, Others), by Application (Less than 20 Years Old, 20 to 30 Years Old, 30 to 45 Years Old, 45 Years Old and Older), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

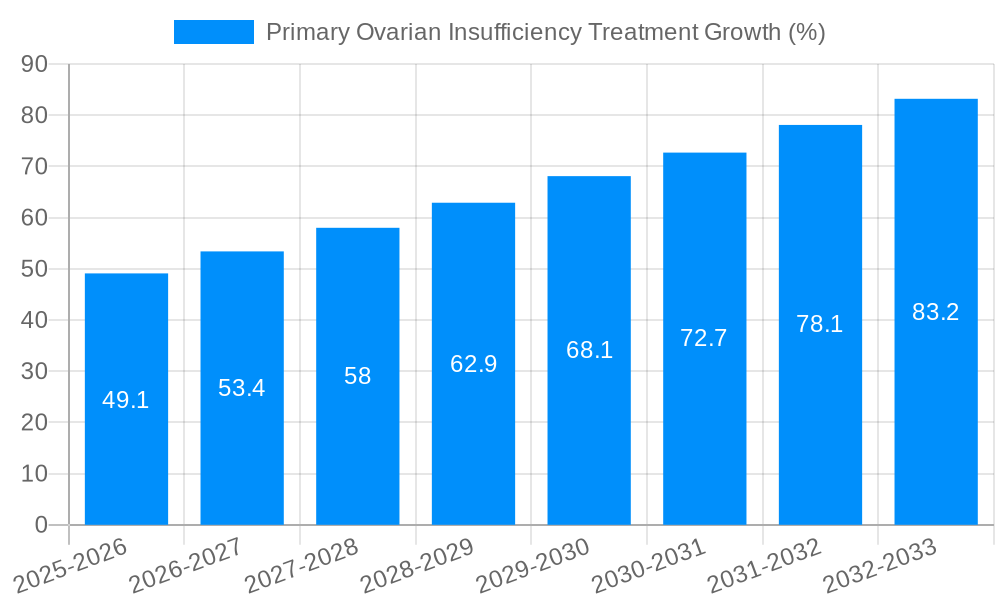

The global market for Primary Ovarian Insufficiency (POI) treatment is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of 6.6% from 2019 to 2033. With a 2025 market size of $735.7 million, the market is driven by several key factors. Increasing awareness of POI and its implications on fertility, coupled with advancements in assisted reproductive technologies (ART) such as In Vitro Fertilization (IVF) and the ongoing research in stem cell therapy, are significant contributors to market expansion. The rising prevalence of POI, particularly among younger women, fuels demand for effective treatments. Furthermore, improved healthcare infrastructure and access to specialized fertility clinics in developed and emerging economies contribute to the market's growth trajectory. The segment comprising Hormone Replacement Therapy (HRT) and Calcium and Vitamin D supplements currently holds a substantial share due to their established role in managing POI symptoms. However, the IVF segment is expected to exhibit the fastest growth due to the increasing number of women seeking fertility treatments. The age demographic of 30 to 45 years old constitutes a substantial portion of the market, representing women actively trying to conceive or manage the consequences of POI.

Geographic distribution shows that North America and Europe currently dominate the market, primarily due to higher healthcare spending, advanced medical infrastructure, and a greater prevalence of POI awareness campaigns. However, the Asia-Pacific region is projected to show significant growth in the coming years, driven by rising disposable incomes, improving healthcare access, and growing awareness of fertility treatments. While the market faces some restraints such as high treatment costs associated with IVF and stem cell therapies, potentially limiting accessibility, the overall market outlook remains positive due to ongoing technological advancements, increased funding for research and development, and a growing patient base seeking effective POI management and fertility solutions. Major players such as Pfizer, Bayer, and Novartis, along with specialized fertility clinics and research institutions like Johns Hopkins Medicine and Mayo Clinic, are driving innovation and expanding treatment options within this dynamic market.

Primary Ovarian Insufficiency Treatment Trends

The global primary ovarian insufficiency (POI) treatment market is experiencing significant growth, projected to reach USD XXX million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033). The market's expansion is fueled by several factors, including rising awareness about POI, advancements in assisted reproductive technologies (ART), and increasing healthcare expenditure globally. The historical period (2019-2024) showcased steady growth, setting the stage for the accelerated expansion predicted in the coming years. The estimated market value in 2025 is USD XXX million, reflecting the current momentum. While Hormone Replacement Therapy (HRT) currently dominates the market due to its established efficacy and widespread availability, the rising adoption of In Vitro Fertilization (IVF) and the burgeoning interest in stem cell therapies are poised to reshape the market landscape in the years to come. The age demographic of patients also plays a crucial role; the 20-30 age group represents a substantial market segment, driven by their strong desire to conceive, while the older age group seeks management of menopausal symptoms associated with POI. The competitive landscape is marked by the presence of major pharmaceutical companies like Pfizer, Bayer, and Novartis, along with specialized fertility clinics and research institutions such as Johns Hopkins Medicine and the Mayo Clinic, all actively contributing to innovation and market expansion. Geographic variations exist, with developed nations exhibiting higher market penetration due to greater awareness and access to advanced treatment options. However, emerging economies present a significant untapped potential for growth as healthcare infrastructure improves and awareness campaigns gain traction. The overall trend signals a dynamic and evolving market with substantial future growth potential.

Driving Forces: What's Propelling the Primary Ovarian Insufficiency Treatment Market?

Several factors are accelerating the growth of the primary ovarian insufficiency (POI) treatment market. Firstly, the increasing awareness of POI among women and healthcare providers is leading to earlier diagnosis and timely intervention. Improved diagnostic techniques and public health campaigns focused on reproductive health are contributing to this heightened awareness. Secondly, advancements in assisted reproductive technologies (ART), particularly IVF, have significantly improved the chances of successful conception for women with POI. This technological progress coupled with the expanding availability of IVF clinics globally, is a major driving force. Thirdly, the rising prevalence of POI itself, potentially linked to lifestyle factors and environmental influences, is creating a larger pool of potential patients. Furthermore, growing healthcare expenditure, especially in developed countries, provides increased access to expensive treatments like IVF and stem cell therapies. The rising disposable income in emerging economies is also contributing to market growth by facilitating access to advanced reproductive healthcare. Finally, the increasing demand for preserving fertility in younger women facing potential risk factors for POI fuels the adoption of egg freezing and other preventative measures, thus indirectly impacting the market for POI treatments later in life.

Challenges and Restraints in Primary Ovarian Insufficiency Treatment

Despite the considerable market potential, several factors pose challenges to the growth of the POI treatment market. High treatment costs, particularly for advanced techniques like IVF and stem cell therapy, represent a significant barrier for many patients, limiting market penetration, especially in developing nations. The availability of effective and affordable treatments remains a key constraint. Additionally, the success rates of some treatments, particularly in older age groups, can be variable, which may influence patient decisions and affect market growth. Ethical concerns surrounding some treatments, such as stem cell therapy, alongside regulatory hurdles related to the approval and implementation of new therapies, also create challenges. Furthermore, the lack of awareness about POI and its management in several parts of the world hinders early diagnosis and intervention, thereby negatively impacting market growth. The geographical disparity in access to specialized medical facilities and trained healthcare professionals further restricts the market's expansion in certain regions. Finally, adverse effects associated with certain treatment options, like HRT, might discourage some patients, thus impacting market growth rates.

Key Region or Country & Segment to Dominate the Market

The North American and European markets are projected to dominate the primary ovarian insufficiency (POI) treatment market throughout the forecast period (2025-2033), driven by higher healthcare expenditure, increased awareness, and advanced healthcare infrastructure. However, the Asia-Pacific region is expected to witness substantial growth, fueled by rising disposable incomes, improving healthcare infrastructure, and a growing awareness of reproductive health issues.

By Type:

Hormone Replacement Therapy (HRT): Currently holds the largest market share due to its widespread use in managing menopausal symptoms associated with POI. However, its long-term safety profile remains a concern, and this could influence future market trends. The market for HRT is valued at USD XXX million in 2025 and is projected to reach USD XXX million by 2033.

In Vitro Fertilization (IVF): This segment is expected to experience significant growth during the forecast period due to its increasing success rates and the rising desire among women with POI to have biological children. The 2025 market valuation is estimated at USD XXX million, and is projected to reach USD XXX million by 2033.

Other Treatments (Including Calcium & Vitamin D Supplements, Stem Cell Therapy): This segment shows promising future growth, driven by ongoing research and development in innovative treatment modalities. Stem cell therapy, in particular, holds significant potential but faces regulatory and cost challenges. The 2025 market valuation is estimated at USD XXX million and is projected to reach USD XXX million by 2033.

By Application:

20 to 30 Years Old: This age group constitutes a significant portion of the market due to the high prevalence of POI diagnosis within this age range and strong desire for childbearing. The market segment for this age group is valued at USD XXX million in 2025, and is projected to reach USD XXX million by 2033.

30 to 45 Years Old: This segment's market share is substantial, reflecting the ongoing need for fertility preservation and management of POI symptoms within this age group. The market segment for this age group is valued at USD XXX million in 2025, and is projected to reach USD XXX million by 2033.

The market segmentation illustrates the diverse treatment approaches and patient demographics driving market expansion.

Growth Catalysts in Primary Ovarian Insufficiency Treatment Industry

Several factors are poised to catalyze growth in the POI treatment market. These include increased research and development focusing on novel therapies and improved diagnostic techniques, leading to better treatment options and earlier intervention. Growing awareness campaigns and public health initiatives promoting reproductive health education contribute significantly. Expansion of healthcare infrastructure and improved access to specialized fertility clinics, particularly in developing economies, will unlock significant market opportunities. Additionally, supportive government policies and insurance coverage for POI treatment can boost market growth, making treatments more accessible.

Leading Players in the Primary Ovarian Insufficiency Treatment Market

- Pfizer

- Bayer

- Novartis

- Bioscience Institute

- Johns Hopkins Medicine

- Mayo Clinic

- Baptist Health

- Indira IVF

Significant Developments in Primary Ovarian Insufficiency Treatment Sector

- 2020: FDA approves a new drug for the treatment of menopausal symptoms associated with POI.

- 2022: A major clinical trial demonstrates promising results for a novel stem cell therapy for POI.

- 2023: Several leading fertility clinics launch new programs focusing on personalized treatments for POI.

Comprehensive Coverage Primary Ovarian Insufficiency Treatment Report

This report provides a comprehensive overview of the primary ovarian insufficiency (POI) treatment market, offering valuable insights into market trends, driving forces, challenges, and growth opportunities. It delves into key segments, leading players, and regional market dynamics, providing a detailed analysis for strategic decision-making in this rapidly evolving sector. The data presented, including market size projections and segment breakdowns, provides a solid foundation for understanding the current market landscape and future prospects of the POI treatment market.

Primary Ovarian Insufficiency Treatment Segmentation

-

1. Type

- 1.1. Hormone Replacement Therapy (HRT)

- 1.2. Calcium and Vitamin D Supplements

- 1.3. In Vitro Fertilization (IVF)

- 1.4. Stem Cell Therapy

- 1.5. Others

-

2. Application

- 2.1. Less than 20 Years Old

- 2.2. 20 to 30 Years Old

- 2.3. 30 to 45 Years Old

- 2.4. 45 Years Old and Older

Primary Ovarian Insufficiency Treatment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Primary Ovarian Insufficiency Treatment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.6% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Primary Ovarian Insufficiency Treatment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hormone Replacement Therapy (HRT)

- 5.1.2. Calcium and Vitamin D Supplements

- 5.1.3. In Vitro Fertilization (IVF)

- 5.1.4. Stem Cell Therapy

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Less than 20 Years Old

- 5.2.2. 20 to 30 Years Old

- 5.2.3. 30 to 45 Years Old

- 5.2.4. 45 Years Old and Older

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Primary Ovarian Insufficiency Treatment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hormone Replacement Therapy (HRT)

- 6.1.2. Calcium and Vitamin D Supplements

- 6.1.3. In Vitro Fertilization (IVF)

- 6.1.4. Stem Cell Therapy

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Less than 20 Years Old

- 6.2.2. 20 to 30 Years Old

- 6.2.3. 30 to 45 Years Old

- 6.2.4. 45 Years Old and Older

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Primary Ovarian Insufficiency Treatment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hormone Replacement Therapy (HRT)

- 7.1.2. Calcium and Vitamin D Supplements

- 7.1.3. In Vitro Fertilization (IVF)

- 7.1.4. Stem Cell Therapy

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Less than 20 Years Old

- 7.2.2. 20 to 30 Years Old

- 7.2.3. 30 to 45 Years Old

- 7.2.4. 45 Years Old and Older

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Primary Ovarian Insufficiency Treatment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hormone Replacement Therapy (HRT)

- 8.1.2. Calcium and Vitamin D Supplements

- 8.1.3. In Vitro Fertilization (IVF)

- 8.1.4. Stem Cell Therapy

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Less than 20 Years Old

- 8.2.2. 20 to 30 Years Old

- 8.2.3. 30 to 45 Years Old

- 8.2.4. 45 Years Old and Older

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Primary Ovarian Insufficiency Treatment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hormone Replacement Therapy (HRT)

- 9.1.2. Calcium and Vitamin D Supplements

- 9.1.3. In Vitro Fertilization (IVF)

- 9.1.4. Stem Cell Therapy

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Less than 20 Years Old

- 9.2.2. 20 to 30 Years Old

- 9.2.3. 30 to 45 Years Old

- 9.2.4. 45 Years Old and Older

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Primary Ovarian Insufficiency Treatment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hormone Replacement Therapy (HRT)

- 10.1.2. Calcium and Vitamin D Supplements

- 10.1.3. In Vitro Fertilization (IVF)

- 10.1.4. Stem Cell Therapy

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Less than 20 Years Old

- 10.2.2. 20 to 30 Years Old

- 10.2.3. 30 to 45 Years Old

- 10.2.4. 45 Years Old and Older

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bioscience Institute

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johns Hopkins Medicine

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mayo Clinic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baptist Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Indira IVF

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Pfizer

- Figure 1: Global Primary Ovarian Insufficiency Treatment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Primary Ovarian Insufficiency Treatment Revenue (million), by Type 2024 & 2032

- Figure 3: North America Primary Ovarian Insufficiency Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Primary Ovarian Insufficiency Treatment Revenue (million), by Application 2024 & 2032

- Figure 5: North America Primary Ovarian Insufficiency Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Primary Ovarian Insufficiency Treatment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Primary Ovarian Insufficiency Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Primary Ovarian Insufficiency Treatment Revenue (million), by Type 2024 & 2032

- Figure 9: South America Primary Ovarian Insufficiency Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Primary Ovarian Insufficiency Treatment Revenue (million), by Application 2024 & 2032

- Figure 11: South America Primary Ovarian Insufficiency Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Primary Ovarian Insufficiency Treatment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Primary Ovarian Insufficiency Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Primary Ovarian Insufficiency Treatment Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Primary Ovarian Insufficiency Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Primary Ovarian Insufficiency Treatment Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Primary Ovarian Insufficiency Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Primary Ovarian Insufficiency Treatment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Primary Ovarian Insufficiency Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Primary Ovarian Insufficiency Treatment Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Primary Ovarian Insufficiency Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Primary Ovarian Insufficiency Treatment Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Primary Ovarian Insufficiency Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Primary Ovarian Insufficiency Treatment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Primary Ovarian Insufficiency Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Primary Ovarian Insufficiency Treatment Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Primary Ovarian Insufficiency Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Primary Ovarian Insufficiency Treatment Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Primary Ovarian Insufficiency Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Primary Ovarian Insufficiency Treatment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Primary Ovarian Insufficiency Treatment Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Primary Ovarian Insufficiency Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Primary Ovarian Insufficiency Treatment Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.6% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.