Private Fertility Service

Private Fertility ServicePrivate Fertility Service Unlocking Growth Potential: Analysis and Forecasts 2025-2033

Private Fertility Service by Application (Infertile People, LGBTQ People), by Type (Egg and Sperm Freezing, Fertility Preservation, DNA Testing, LGBTQ+ Family Building, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The private fertility services market, valued at $58.07 billion in 2025, is experiencing robust growth, driven by several key factors. Rising infertility rates globally, coupled with increased awareness and acceptance of assisted reproductive technologies (ARTs) like IVF, egg freezing, and sperm freezing, are significant contributors to market expansion. The LGBTQ+ community's increasing desire to build families through fertility treatments is another major driver. Furthermore, advancements in genetic testing and preimplantation genetic diagnosis (PGD) are enhancing the success rates of fertility treatments and increasing demand for these specialized services. The market is segmented by application (infertile individuals, LGBTQ+ individuals) and type of service (egg/sperm freezing, fertility preservation, DNA testing, LGBTQ+ family building). Geographic expansion, particularly in developing economies with rising disposable incomes and improved healthcare infrastructure, presents significant growth opportunities. However, high treatment costs and stringent regulations in some regions pose challenges to market penetration. Competitive intensity is also increasing with numerous established players and new entrants vying for market share. The market's future growth trajectory will depend on technological advancements, regulatory changes, and ongoing public discourse surrounding reproductive rights and access to fertility services.

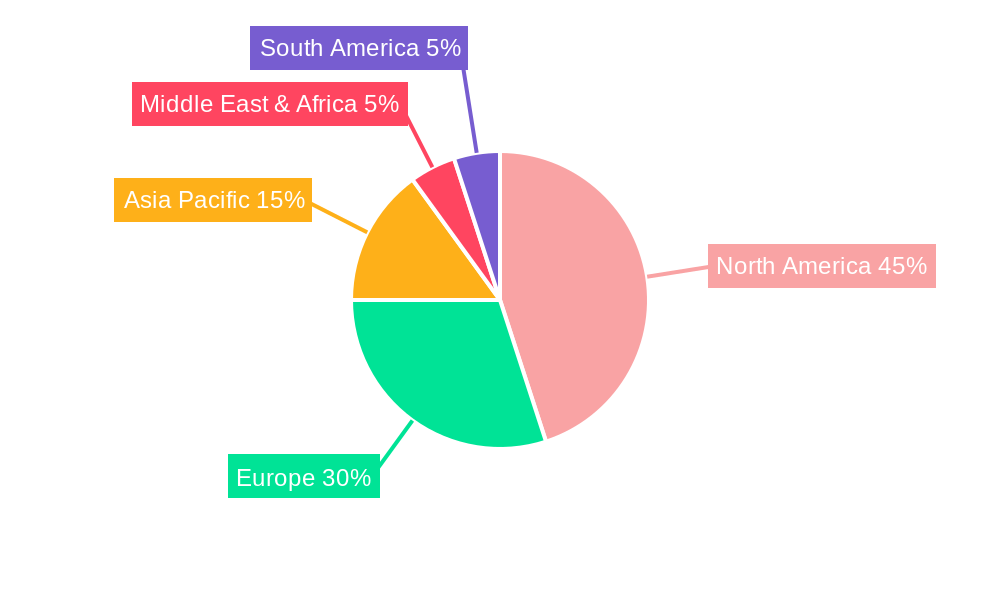

The forecast period (2025-2033) anticipates a sustained expansion, potentially exceeding a CAGR of 5% (a conservative estimate considering the dynamic nature of the market). This growth will be fueled by ongoing technological improvements leading to safer and more effective treatments, along with a broadening acceptance of fertility treatments within society. However, variations in growth rates across geographical segments are anticipated, with North America and Europe maintaining a significant market share due to higher adoption rates and established healthcare infrastructure. Asia-Pacific is poised for substantial growth driven by increasing awareness and expanding healthcare access. Addressing affordability concerns and expanding access to these services, especially in underserved regions, will be crucial for long-term market sustainability and equitable access to reproductive healthcare.

Private Fertility Service Trends

The private fertility service market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. Driven by increasing infertility rates globally, advancements in assisted reproductive technologies (ART), and a growing acceptance of fertility treatments, the market shows significant potential. Over the historical period (2019-2024), we witnessed a steady rise in demand, particularly for services like in-vitro fertilization (IVF) and egg freezing. The estimated year 2025 shows a consolidation of market players, with larger chains acquiring smaller clinics to expand their reach and service offerings. The forecast period (2025-2033) anticipates continued growth, fueled by technological innovations and expanding access to fertility services, particularly among LGBTQ+ individuals and those delaying parenthood. This expansion includes a wider range of services beyond traditional IVF, encompassing genetic screening, fertility preservation, and surrogacy options. Market trends indicate a shift towards personalized medicine within fertility treatments, with increased focus on genetic testing and tailored treatment plans to maximize success rates. The rising cost of fertility treatments remains a significant factor, with varying levels of insurance coverage impacting accessibility across different demographics and geographical locations. Competition amongst providers is intensifying, leading to a greater focus on patient experience, technological advancements, and cost-effective solutions. The market is also seeing an increasing demand for transparent and accessible pricing models.

Driving Forces: What's Propelling the Private Fertility Service

Several factors contribute to the rapid expansion of the private fertility service market. Firstly, the rising prevalence of infertility, influenced by delayed childbearing, lifestyle factors, and environmental influences, creates a substantial demand for advanced fertility treatments. Secondly, technological advancements, such as improved IVF techniques, preimplantation genetic testing (PGT), and advancements in egg and sperm freezing, have significantly increased success rates and broadened access to fertility services. Thirdly, the increasing acceptance and normalization of fertility treatments, particularly among LGBTQ+ individuals and single people by choice, fuels market growth. The rise of social media and online platforms has also played a crucial role in destigmatizing fertility struggles and promoting open conversations about family planning. Fourthly, the expanding awareness of fertility preservation options, especially among younger individuals, contributes significantly. Individuals are proactively freezing their eggs or sperm to safeguard their future reproductive choices, driving demand for related services. Finally, the growing number of specialized fertility clinics and centers offering a wider range of services is another major driver, resulting in increased competition and better patient outcomes.

Challenges and Restraints in Private Fertility Service

Despite significant growth, the private fertility service market faces considerable challenges. The high cost of fertility treatments is a major barrier for many individuals and couples, limiting accessibility. Insurance coverage varies widely across different regions and countries, making treatments unaffordable for a substantial portion of the population. Ethical concerns surrounding practices like preimplantation genetic diagnosis (PGD) and surrogacy continue to generate debate and regulatory complexities. Furthermore, the emotional and psychological toll of infertility and fertility treatments can significantly impact patient well-being, necessitating improved support systems and counseling services. Stricter regulations and ethical guidelines imposed by governing bodies, while necessary for patient safety, can limit the market's expansion and innovation. Lastly, the competitive landscape, with numerous clinics vying for patients, can lead to price wars and pressures on profit margins for individual service providers.

Key Region or Country & Segment to Dominate the Market

The LGBTQ+ Family Building segment is projected to experience significant growth within the private fertility service market. This is driven by several factors:

Increased Social Acceptance: Growing social acceptance of LGBTQ+ relationships and families has significantly increased the number of couples seeking fertility services to build their families.

Technological Advancements: Advances in ART, particularly IVF and surrogacy, have made it easier and more accessible for LGBTQ+ individuals to conceive and have children.

Targeted Marketing and Services: Many fertility clinics are specifically tailoring their services and marketing strategies to meet the unique needs of the LGBTQ+ community.

Legal Frameworks: While still evolving, supportive legal frameworks in many regions are increasingly recognizing and protecting the rights of LGBTQ+ couples to access fertility treatments.

Higher Disposable Incomes: In several developed countries, the LGBTQ+ community often has higher disposable incomes, increasing their capacity to afford these expensive treatments.

Growing Awareness: Increased awareness campaigns and advocacy efforts have broadened knowledge about LGBTQ+-inclusive fertility options.

Regional Variations: Growth will vary based on legal frameworks, social acceptance, and economic factors. Regions with progressive legislation and strong social support networks will experience greater expansion than others. North America and parts of Western Europe are likely to dominate initially, followed by gradual growth in other developed and emerging economies.

In summary, the LGBTQ+ family building segment presents a considerable opportunity for growth within the private fertility service market, propelled by social, technological, and legal advancements. However, it is crucial to address ongoing challenges related to costs, access, and ethical considerations to ensure equitable access for all.

Growth Catalysts in Private Fertility Service Industry

Several factors are catalyzing growth in the private fertility services industry. The development of less invasive and more effective fertility treatments is reducing costs and improving success rates. Simultaneously, increasing awareness and reduced stigma surrounding infertility are prompting more people to seek help. Furthermore, favorable regulatory environments in some regions are enhancing market access and fostering innovation. The rising disposable income in several countries also empowers more people to afford these services.

Leading Players in the Private Fertility Service

- King's Fertility

- Kindbody [Kindbody]

- ORM Fertility

- CCRM Fertility [CCRM Fertility]

- Extend Fertility [Extend Fertility]

- Hatch Fertility [Hatch Fertility]

- Pacific Fertility Center Los Angeles

- Columbia Fertility Associates

- Care Fertility

- Main Line Fertility

- IVFMD

- Aspire Fertility

- World Fertility Services

- We Care Ivf Surrogacy

- Go IVF Surroagacy

- New Hope Fertility Center

- Utah Fertility Center

Significant Developments in Private Fertility Service Sector

- 2020: Increased adoption of telehealth for initial consultations and monitoring during fertility treatments.

- 2021: Several major players announced expansions into new geographical locations and service offerings.

- 2022: Significant advancements in preimplantation genetic testing (PGT) improving diagnostic accuracy and reducing risks.

- 2023: Focus on personalized medicine approaches to fertility treatments.

- 2024: Launch of several new fertility apps and digital platforms enhancing patient experience and access to information.

Comprehensive Coverage Private Fertility Service Report

This report provides a comprehensive analysis of the private fertility service market, covering market size, trends, growth drivers, challenges, key players, and significant developments from 2019 to 2033. The detailed segmentation by application (infertile people, LGBTQ people) and type of service (egg and sperm freezing, fertility preservation, etc.) provides a granular view of the market dynamics. The report also includes detailed financial projections, regional analysis, and competitive landscape assessment, making it a valuable resource for stakeholders in the industry.

Private Fertility Service Segmentation

-

1. Application

- 1.1. Infertile People

- 1.2. LGBTQ People

-

2. Type

- 2.1. Egg and Sperm Freezing

- 2.2. Fertility Preservation

- 2.3. DNA Testing

- 2.4. LGBTQ+ Family Building

- 2.5. Others

Private Fertility Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Private Fertility Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Private Fertility Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Infertile People

- 5.1.2. LGBTQ People

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Egg and Sperm Freezing

- 5.2.2. Fertility Preservation

- 5.2.3. DNA Testing

- 5.2.4. LGBTQ+ Family Building

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Private Fertility Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Infertile People

- 6.1.2. LGBTQ People

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Egg and Sperm Freezing

- 6.2.2. Fertility Preservation

- 6.2.3. DNA Testing

- 6.2.4. LGBTQ+ Family Building

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Private Fertility Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Infertile People

- 7.1.2. LGBTQ People

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Egg and Sperm Freezing

- 7.2.2. Fertility Preservation

- 7.2.3. DNA Testing

- 7.2.4. LGBTQ+ Family Building

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Private Fertility Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Infertile People

- 8.1.2. LGBTQ People

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Egg and Sperm Freezing

- 8.2.2. Fertility Preservation

- 8.2.3. DNA Testing

- 8.2.4. LGBTQ+ Family Building

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Private Fertility Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Infertile People

- 9.1.2. LGBTQ People

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Egg and Sperm Freezing

- 9.2.2. Fertility Preservation

- 9.2.3. DNA Testing

- 9.2.4. LGBTQ+ Family Building

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Private Fertility Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Infertile People

- 10.1.2. LGBTQ People

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Egg and Sperm Freezing

- 10.2.2. Fertility Preservation

- 10.2.3. DNA Testing

- 10.2.4. LGBTQ+ Family Building

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 King's Fertility

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kindbody

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ORM Fertility

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CCRM Fertility

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Extend Fertility

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hatch Fertility

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pacific Fertility Center Los Angeles

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Columbia Fertility Associates

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Care Fertility

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Main Line Fertility

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IVFMD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aspire Fertility

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 World Fertility Services

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 We Care Ivf Surrogacy

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Go IVF Surroagacy

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 New Hope Fertility Center

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Utah Fertility Center

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 King's Fertility

- Figure 1: Global Private Fertility Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Private Fertility Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Private Fertility Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Private Fertility Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Private Fertility Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Private Fertility Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Private Fertility Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Private Fertility Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Private Fertility Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Private Fertility Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Private Fertility Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Private Fertility Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Private Fertility Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Private Fertility Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Private Fertility Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Private Fertility Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Private Fertility Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Private Fertility Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Private Fertility Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Private Fertility Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Private Fertility Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Private Fertility Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Private Fertility Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Private Fertility Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Private Fertility Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Private Fertility Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Private Fertility Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Private Fertility Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Private Fertility Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Private Fertility Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Private Fertility Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Private Fertility Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Private Fertility Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Private Fertility Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Private Fertility Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Private Fertility Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Private Fertility Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Private Fertility Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Private Fertility Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Private Fertility Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Private Fertility Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Private Fertility Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Private Fertility Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Private Fertility Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Private Fertility Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Private Fertility Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Private Fertility Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Private Fertility Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Private Fertility Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Private Fertility Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Private Fertility Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.