Secondhand Fashion Platform

Secondhand Fashion PlatformSecondhand Fashion Platform Analysis 2025 and Forecasts 2033: Unveiling Growth Opportunities

Secondhand Fashion Platform by Type (B to C, C to C), by Application (Clothing, Accessories, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

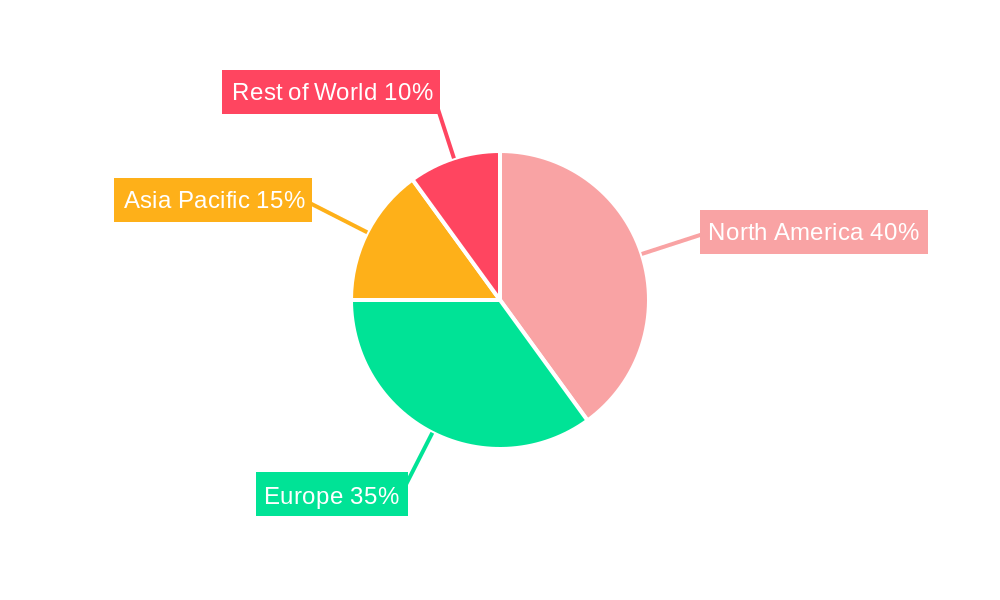

The secondhand fashion market is experiencing explosive growth, driven by increasing consumer awareness of sustainability, affordability concerns, and the desire for unique, pre-owned items. This burgeoning sector, encompassing platforms connecting buyers and sellers of used clothing and accessories, is projected to maintain a significant Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). The market's segmentation reveals a strong presence of both business-to-consumer (B2C) and consumer-to-consumer (C2C) platforms, with clothing dominating the application segment. Key players like Depop, Vestiaire Collective, and ThredUp are establishing themselves as major forces, leveraging technology to enhance the buying and selling experience. The market's success is further fueled by the rise of social commerce, with platforms like Facebook Marketplace and Instagram playing a significant role. Geographic distribution shows strong growth across North America and Europe, but significant opportunities exist in rapidly developing economies within Asia-Pacific and other regions. The market faces challenges such as authenticity verification, logistics complexities, and managing fluctuating supply and demand.

Despite these challenges, the long-term outlook remains extremely positive. Continued growth is anticipated due to evolving consumer preferences, technological advancements in authentication and logistics, and the increasing integration of secondhand fashion into mainstream retail. The rise of luxury resale platforms caters to a growing demand for pre-owned high-end items, further diversifying the market. This trend will likely drive innovation in areas such as personalized recommendations, augmented reality try-ons, and improved fraud prevention measures. Strategic partnerships between established brands and secondhand platforms will also contribute to market expansion. The overall trend indicates a sustained shift towards circular fashion, making the secondhand fashion market a compelling investment opportunity with significant long-term growth potential.

Secondhand Fashion Platform Trends

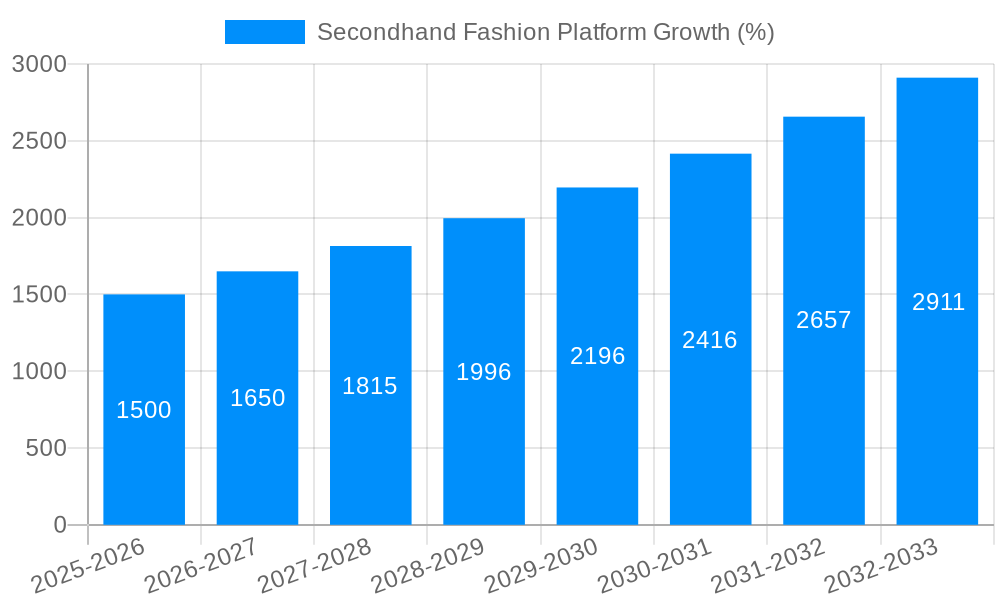

The secondhand fashion platform market is experiencing explosive growth, projected to reach tens of billions of dollars by 2033. This surge is driven by a confluence of factors, including increasing consumer awareness of sustainability, the desire for unique and affordable fashion, and the accessibility offered by online platforms. The market, encompassing both business-to-consumer (B2C) and consumer-to-consumer (C2C) models, shows a clear preference for clothing, with accessories and other items following closely behind. The historical period (2019-2024) witnessed a significant shift in consumer behavior, with a marked increase in the adoption of online secondhand platforms. This trend is expected to continue exponentially during the forecast period (2025-2033), propelled by technological advancements and evolving consumer preferences. The estimated market size in 2025 stands at several billion dollars, indicating the substantial growth trajectory already underway. This report analyzes the key market trends, driving forces, challenges, and leading players within this dynamic sector, providing crucial insights for businesses and investors alike. Competition is fierce, with established giants like eBay and newer, specialized platforms vying for market share. The successful players are those adapting quickly to changing consumer demands, integrating innovative technologies, and successfully navigating the complexities of authentication and logistics in the secondhand market. Furthermore, the market is demonstrating significant regional variations, with certain countries and regions showing faster growth rates than others due to factors like consumer purchasing power, digital penetration, and existing infrastructure. Understanding these regional nuances is crucial for strategic decision-making in this burgeoning industry.

Driving Forces: What's Propelling the Secondhand Fashion Platform

Several powerful factors are fueling the remarkable growth of the secondhand fashion platform market. Firstly, the rising awareness of sustainability and the environmental impact of fast fashion is prompting consumers to seek more eco-friendly alternatives. Buying secondhand drastically reduces textile waste and the carbon footprint associated with clothing production. Secondly, the appeal of affordability is undeniable; secondhand clothing offers significant cost savings compared to new items, making it an attractive option for budget-conscious consumers. Thirdly, the increasing accessibility of online platforms has made it easier than ever before to browse, buy, and sell secondhand clothing. The convenience of online shopping, coupled with user-friendly interfaces and secure payment options, is significantly contributing to market expansion. Furthermore, the unique and curated nature of secondhand fashion appeals to a growing segment of consumers seeking distinctive styles that are not readily available in mainstream retail. The opportunity to discover one-of-a-kind items and vintage pieces adds to the allure of secondhand shopping. Finally, the rise of social media influencers promoting sustainable and ethical consumption patterns further boosts the popularity of secondhand fashion platforms, making them a significant factor in reshaping the fashion industry's landscape.

Challenges and Restraints in Secondhand Fashion Platform

Despite the significant growth potential, the secondhand fashion platform market faces several challenges. Authentication is a critical concern, particularly for luxury items. Verifying the authenticity of products and protecting buyers from counterfeit goods requires robust verification processes and significant investment in technology. Logistics and shipping costs also present a considerable challenge, particularly for cross-border transactions and handling items requiring special care. Maintaining platform trust and ensuring a positive user experience are essential for success. Negative reviews or experiences can quickly damage a platform's reputation, impacting customer acquisition and retention. Competition is intense, with many players vying for market share, necessitating continuous innovation and adaptation to stay ahead of the curve. Furthermore, the seasonality of fashion trends can impact sales, particularly for specific items or styles. Effectively managing inventory and predicting demand are crucial for profitability. Finally, regulations and legal frameworks regarding secondhand goods vary across regions, presenting compliance challenges for businesses operating internationally.

Key Region or Country & Segment to Dominate the Market

The C2C segment is currently dominating the market, representing a substantial portion of the overall transaction volume. This is fueled by the ease of selling and buying directly between individuals, facilitated by user-friendly mobile applications. The clothing segment consistently remains the largest revenue generator, reflecting the widespread popularity of secondhand clothing purchases. While many regions are experiencing rapid growth, North America and Europe are currently leading in terms of market size, driven by high levels of online penetration, disposable income, and strong environmental consciousness among consumers.

C2C Segment Dominance: The peer-to-peer nature of C2C transactions fosters community building and trust among users, driving higher engagement and repeat business. Several platforms are specializing in this model, further consolidating this segment's leadership.

Clothing Segment's Continued Strength: The sheer volume and diversity of clothing items available secondhand fuel this segment's dominance. This reflects the adaptability of clothing to various styles and occasions, making it a highly sought-after item in the secondhand market.

North America and Europe as Key Regions: These regions boast high levels of digital literacy and consumer spending, along with a rapidly growing awareness of sustainable practices. Strong regulatory frameworks and a well-developed logistics infrastructure further enhance the market's maturity in these areas.

Emerging Markets Show Promise: Developing economies, while currently representing a smaller share, display exceptional growth potential due to increasing internet access and rising disposable incomes.

Growth Catalysts in Secondhand Fashion Platform Industry

The secondhand fashion platform industry’s growth is fueled by several key catalysts, including rising environmental consciousness among consumers leading to a preference for sustainable options, the affordability of secondhand apparel compared to new purchases, and technological advancements which have made the buying and selling of secondhand goods increasingly convenient and accessible through user-friendly mobile applications and secure online payment systems.

Leading Players in the Secondhand Fashion Platform

- Depop

- Vestiaire Collective

- Vinted

- eBay

- The RealReal

- ThredUp

- Tradesy

- Hardly Ever Worn It

- Rebag

- StockX

- My Wardrobe HQ

- Fashionphile

- REBELLE

- Tise

- HULA

- Carousell

- Luxford

- Retykle

- Rokit

- Grailed

- Thrift+

- Asos

- Re-SEE

- Collector Square

- Swap Society

- Flyp

- REI

- Geartrade

- Worn Wear

- Regain

- Refashioner

- Shrimpton Couture

- Crossroads Trading

- The Closet

Significant Developments in Secondhand Fashion Platform Sector

- 2020: Increased investment in authentication technology by major players.

- 2021: Launch of several new C2C platforms specializing in specific niches (e.g., luxury handbags).

- 2022: Growing integration of blockchain technology for enhanced transparency and authenticity verification.

- 2023: Significant increase in marketing campaigns promoting sustainable fashion and secondhand platforms.

- 2024: Expansion of secondhand platforms into new geographical markets.

Comprehensive Coverage Secondhand Fashion Platform Report

This report provides an in-depth analysis of the secondhand fashion platform market, encompassing historical data, current market dynamics, and future projections. It identifies key trends, growth drivers, challenges, and leading players in the industry, providing valuable insights for businesses and investors seeking to navigate this rapidly evolving sector. The detailed market segmentation and regional analysis provide a comprehensive understanding of the market's structure and potential.

Secondhand Fashion Platform Segmentation

-

1. Type

- 1.1. B to C

- 1.2. C to C

-

2. Application

- 2.1. Clothing

- 2.2. Accessories

- 2.3. Other

Secondhand Fashion Platform Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Secondhand Fashion Platform REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Secondhand Fashion Platform Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B to C

- 5.1.2. C to C

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Clothing

- 5.2.2. Accessories

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Secondhand Fashion Platform Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. B to C

- 6.1.2. C to C

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Clothing

- 6.2.2. Accessories

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Secondhand Fashion Platform Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. B to C

- 7.1.2. C to C

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Clothing

- 7.2.2. Accessories

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Secondhand Fashion Platform Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. B to C

- 8.1.2. C to C

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Clothing

- 8.2.2. Accessories

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Secondhand Fashion Platform Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. B to C

- 9.1.2. C to C

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Clothing

- 9.2.2. Accessories

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Secondhand Fashion Platform Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. B to C

- 10.1.2. C to C

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Clothing

- 10.2.2. Accessories

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Depop

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vestiaire Collective

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vinted

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 eBay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The RealReal

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ThredUp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tradesy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hardly Ever Worn It

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rebag

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 StockX

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 My Wardrobe HQ

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fashionphile

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 REBELLE

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tise

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HULA

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Carousell

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Luxford

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Retykle

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Rokit

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Grailed

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Thrift.Plus

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Facebook

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Asos

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Re-SEE

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Collector Square

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Swap Society

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Flyp

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 REI

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Geartrade

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Worn Wear

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Regain

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Refashioner

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 Shrimpton Couture

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Crossroads Trading

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 The Closet

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.1 Depop

- Figure 1: Global Secondhand Fashion Platform Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Secondhand Fashion Platform Revenue (million), by Type 2024 & 2032

- Figure 3: North America Secondhand Fashion Platform Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Secondhand Fashion Platform Revenue (million), by Application 2024 & 2032

- Figure 5: North America Secondhand Fashion Platform Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Secondhand Fashion Platform Revenue (million), by Country 2024 & 2032

- Figure 7: North America Secondhand Fashion Platform Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Secondhand Fashion Platform Revenue (million), by Type 2024 & 2032

- Figure 9: South America Secondhand Fashion Platform Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Secondhand Fashion Platform Revenue (million), by Application 2024 & 2032

- Figure 11: South America Secondhand Fashion Platform Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Secondhand Fashion Platform Revenue (million), by Country 2024 & 2032

- Figure 13: South America Secondhand Fashion Platform Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Secondhand Fashion Platform Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Secondhand Fashion Platform Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Secondhand Fashion Platform Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Secondhand Fashion Platform Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Secondhand Fashion Platform Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Secondhand Fashion Platform Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Secondhand Fashion Platform Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Secondhand Fashion Platform Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Secondhand Fashion Platform Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Secondhand Fashion Platform Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Secondhand Fashion Platform Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Secondhand Fashion Platform Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Secondhand Fashion Platform Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Secondhand Fashion Platform Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Secondhand Fashion Platform Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Secondhand Fashion Platform Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Secondhand Fashion Platform Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Secondhand Fashion Platform Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Secondhand Fashion Platform Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Secondhand Fashion Platform Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Secondhand Fashion Platform Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Secondhand Fashion Platform Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Secondhand Fashion Platform Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Secondhand Fashion Platform Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Secondhand Fashion Platform Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Secondhand Fashion Platform Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Secondhand Fashion Platform Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Secondhand Fashion Platform Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Secondhand Fashion Platform Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Secondhand Fashion Platform Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Secondhand Fashion Platform Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Secondhand Fashion Platform Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Secondhand Fashion Platform Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Secondhand Fashion Platform Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Secondhand Fashion Platform Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Secondhand Fashion Platform Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Secondhand Fashion Platform Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Secondhand Fashion Platform Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.