Silver Nanowire Transparent

Silver Nanowire TransparentSilver Nanowire Transparent Insightful Analysis: Trends, Competitor Dynamics, and Opportunities 2025-2033

Silver Nanowire Transparent by Type (20nm Silver Nanowire, 30nm Silver Nanowire, 50nm Silver Nanowire, Others), by Application (Touch Screens, OLED Lighting, PV Panels, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The silver nanowire transparent conductive film (TCF) market is experiencing robust growth, driven by increasing demand across diverse applications. The market's expansion is fueled primarily by the superior performance of silver nanowires compared to traditional materials like indium tin oxide (ITO). Silver nanowires offer higher conductivity, flexibility, and better optical transparency, making them ideal for applications requiring advanced functionalities. The touch screen segment currently dominates the market, owing to the widespread adoption of smartphones and tablets. However, substantial growth is anticipated in the OLED lighting and PV panel segments, driven by the increasing adoption of flexible displays and the need for more efficient solar energy solutions. The 20nm silver nanowire segment holds a significant market share due to its superior performance characteristics in various applications. Technological advancements focusing on cost reduction and scalability of silver nanowire production are further boosting market expansion. While the market faces challenges related to the cost-effectiveness of silver nanowire production and potential long-term stability concerns, these are being actively addressed by industry players through ongoing research and development. Geographical distribution reflects strong growth across North America and Asia Pacific, primarily driven by substantial investments in electronics manufacturing and renewable energy initiatives in these regions. The overall market is expected to maintain a healthy CAGR throughout the forecast period (2025-2033), indicating a promising future for this innovative material.

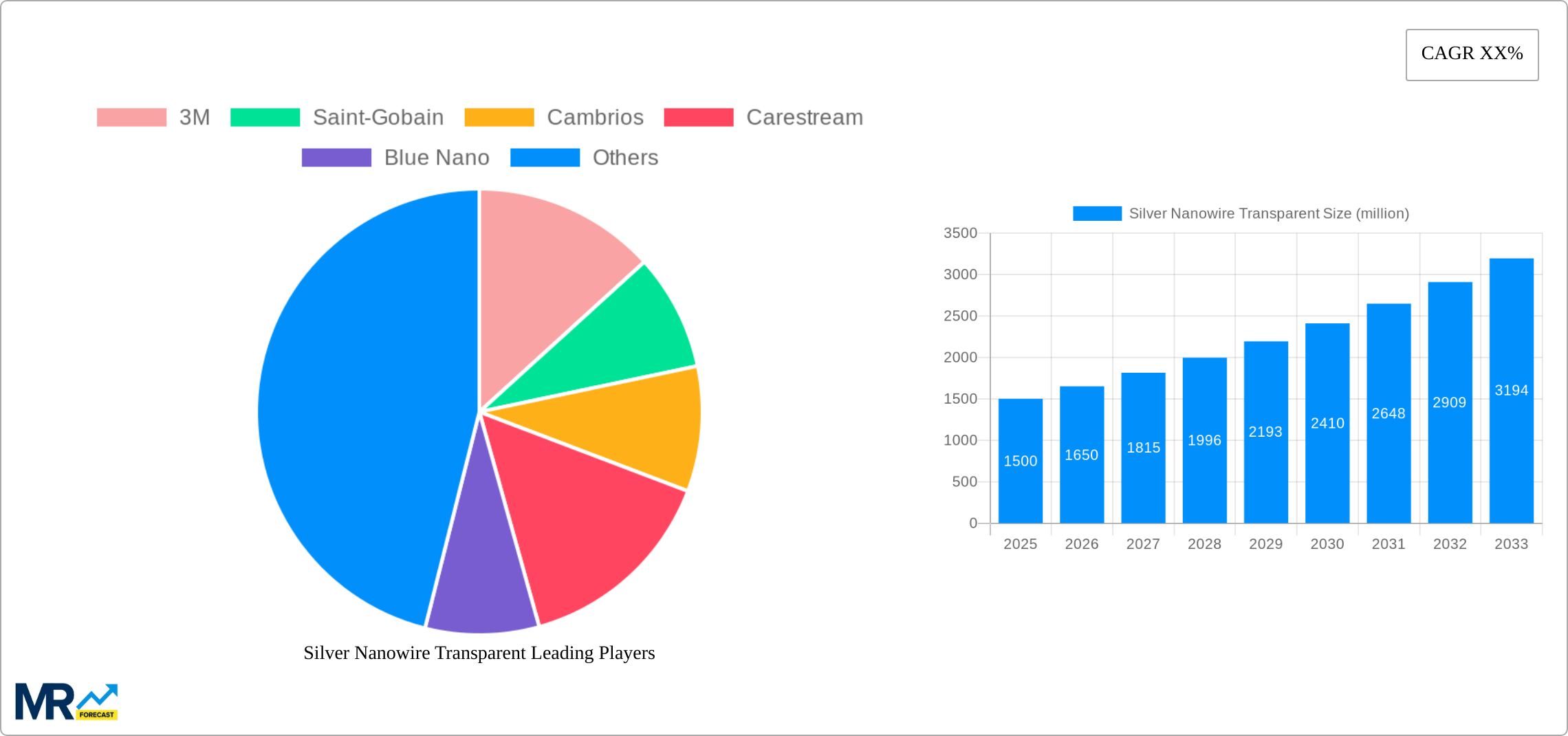

The competitive landscape is marked by a mix of established players and emerging companies specializing in silver nanowire production and integration. Major players like 3M and Saint-Gobain are leveraging their existing market presence and manufacturing expertise to capture a significant portion of the market share. Meanwhile, smaller companies are focusing on niche applications and innovative solutions. Strategic partnerships and collaborations are becoming increasingly prevalent, driving innovation and accelerating market penetration. Future market growth will likely be shaped by several factors, including ongoing research into enhancing the cost-effectiveness and scalability of silver nanowire production, exploration of novel applications, and increasing governmental support for renewable energy technologies. The focus on developing sustainable and cost-effective manufacturing processes will be crucial for realizing the full potential of silver nanowires in the years to come.

Silver Nanowire Transparent Trends

The global silver nanowire transparent conductive film market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by the increasing demand for flexible and transparent electronics, the market witnessed significant expansion during the historical period (2019-2024), with an accelerated growth trajectory anticipated during the forecast period (2025-2033). The estimated market value in 2025 surpasses several million units, indicating substantial market penetration. Key market insights reveal a strong preference for smaller diameter nanowires (20nm and 30nm) due to their superior optical and electrical properties, leading to their dominance in several application segments. The touch screen sector currently holds the largest market share, propelled by the burgeoning smartphone and tablet markets. However, the OLED lighting and PV panel sectors are emerging as significant growth drivers, promising substantial market expansion in the coming years. The competitive landscape is characterized by a mix of established materials companies and specialized nanomaterials manufacturers, each vying for market share through innovative product development and strategic partnerships. Price competition and the ongoing need to improve the long-term stability and durability of silver nanowire films remain key considerations impacting market dynamics. The market's success hinges on continuous technological advancements addressing challenges like cost-effectiveness and scalability to meet the growing demand for high-performance, flexible transparent conductive films across diverse applications.

Driving Forces: What's Propelling the Silver Nanowire Transparent Conductive Film Market?

Several factors are propelling the growth of the silver nanowire transparent conductive film market. The increasing demand for flexible displays in consumer electronics (smartphones, tablets, wearable devices) is a primary driver, with silver nanowires offering superior flexibility compared to traditional indium tin oxide (ITO). The rising adoption of OLED lighting and solar photovoltaic (PV) panels further boosts market demand, as silver nanowires enhance efficiency and transparency in these applications. The ongoing research and development efforts focused on improving the scalability and cost-effectiveness of silver nanowire production are also contributing significantly to market expansion. Moreover, the growing preference for lightweight and energy-efficient electronics fuels the adoption of silver nanowires as a replacement for heavier and less efficient materials. The advantageous properties of silver nanowires, such as high conductivity, transparency, and flexibility, position them as an ideal material for a wide array of applications, fostering market growth across diverse sectors. Government initiatives promoting the development and adoption of sustainable and eco-friendly technologies also contribute to market expansion.

Challenges and Restraints in Silver Nanowire Transparent Conductive Film Market

Despite the significant growth potential, the silver nanowire transparent conductive film market faces several challenges. High production costs remain a major hurdle, hindering wider adoption, particularly in price-sensitive applications. Ensuring the long-term stability and durability of silver nanowire films is crucial for maintaining their performance and preventing degradation over time. This requires addressing issues such as oxidation and aggregation of nanowires. The scalability of the manufacturing process to meet the increasing demand remains a significant challenge. Furthermore, competition from alternative transparent conductive materials, such as graphene and carbon nanotubes, presents a challenge to market growth. Addressing these issues through innovative research and development, process optimization, and cost reduction strategies is crucial for realizing the full potential of this market. Finally, the environmental impact of silver nanowire production and disposal needs careful consideration and management.

Key Region or Country & Segment to Dominate the Market

Dominant Segments:

20nm Silver Nanowire: This segment holds a significant market share due to its superior optical transparency and electrical conductivity compared to larger diameter nanowires. The smaller size allows for higher density and better performance in applications requiring high transparency and low sheet resistance.

Touch Screens: This application segment accounts for the largest share of the market. The increasing demand for smartphones, tablets, and other touch-screen devices drives the substantial growth of this segment. The flexibility and transparency of silver nanowire films make them an ideal material for next-generation flexible touch screens.

Dominant Regions:

- Asia-Pacific: This region is expected to dominate the market due to the high concentration of electronics manufacturing and the burgeoning consumer electronics market. Countries like China, South Korea, and Japan are key contributors to the market's growth. The substantial investment in research and development, coupled with robust government support for technological advancements, further fuels the market's expansion in this region. The region benefits from a strong ecosystem of manufacturers, suppliers, and end-users, creating a conducive environment for market growth. The lower manufacturing costs in some parts of the region also contribute to its dominance.

The strong demand for flexible electronics, coupled with the superior properties of 20nm silver nanowires, makes this combination a key growth driver within the overall silver nanowire transparent conductive film market. The Asia-Pacific region's robust electronics manufacturing sector and supportive government policies consolidate its position as the leading regional market.

Growth Catalysts in Silver Nanowire Transparent Industry

The silver nanowire transparent conductive film industry's growth is significantly fueled by the continuous advancements in nanomaterials technology, leading to improved cost-effectiveness and enhanced product performance. The increasing demand for flexible electronics and the rising adoption of OLED displays and solar cells in various applications further propel market expansion. Government initiatives promoting the development of sustainable and eco-friendly technologies provide additional impetus for market growth.

Leading Players in the Silver Nanowire Transparent Conductive Film Market

- 3M (3M)

- Saint-Gobain (Saint-Gobain)

- Cambrios

- Carestream

- Blue Nano

- Cima NanoTech

- ClearJet

- InkTec

- Innova Dynamics

- Seashell Technology

- Novarials

- PlasmaChem

Significant Developments in Silver Nanowire Transparent Sector

- 2021 Q4: Cima NanoTech announces a new production line for high-volume silver nanowire production.

- 2022 Q2: 3M releases a new generation of silver nanowire-based transparent conductive films with improved durability.

- 2023 Q1: A joint venture between Saint-Gobain and a Korean nanomaterials company is formed to expand the production capacity of silver nanowires in Asia.

Comprehensive Coverage Silver Nanowire Transparent Conductive Film Report

This report provides a detailed analysis of the silver nanowire transparent conductive film market, covering historical data, current market trends, and future projections. The report encompasses a comprehensive assessment of market drivers, restraints, opportunities, and competitive landscape. Detailed segmentation by type, application, and region provides in-depth insights into specific market segments and their growth trajectories. The report also includes profiles of key players in the market, highlighting their strategies and market positioning. This comprehensive overview enables businesses to make informed decisions and capitalize on growth opportunities within the dynamic silver nanowire transparent conductive film market.

Silver Nanowire Transparent Segmentation

-

1. Type

- 1.1. 20nm Silver Nanowire

- 1.2. 30nm Silver Nanowire

- 1.3. 50nm Silver Nanowire

- 1.4. Others

-

2. Application

- 2.1. Touch Screens

- 2.2. OLED Lighting

- 2.3. PV Panels

- 2.4. Others

Silver Nanowire Transparent Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Silver Nanowire Transparent REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silver Nanowire Transparent Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. 20nm Silver Nanowire

- 5.1.2. 30nm Silver Nanowire

- 5.1.3. 50nm Silver Nanowire

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Touch Screens

- 5.2.2. OLED Lighting

- 5.2.3. PV Panels

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Silver Nanowire Transparent Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. 20nm Silver Nanowire

- 6.1.2. 30nm Silver Nanowire

- 6.1.3. 50nm Silver Nanowire

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Touch Screens

- 6.2.2. OLED Lighting

- 6.2.3. PV Panels

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Silver Nanowire Transparent Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. 20nm Silver Nanowire

- 7.1.2. 30nm Silver Nanowire

- 7.1.3. 50nm Silver Nanowire

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Touch Screens

- 7.2.2. OLED Lighting

- 7.2.3. PV Panels

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Silver Nanowire Transparent Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. 20nm Silver Nanowire

- 8.1.2. 30nm Silver Nanowire

- 8.1.3. 50nm Silver Nanowire

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Touch Screens

- 8.2.2. OLED Lighting

- 8.2.3. PV Panels

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Silver Nanowire Transparent Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. 20nm Silver Nanowire

- 9.1.2. 30nm Silver Nanowire

- 9.1.3. 50nm Silver Nanowire

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Touch Screens

- 9.2.2. OLED Lighting

- 9.2.3. PV Panels

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Silver Nanowire Transparent Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. 20nm Silver Nanowire

- 10.1.2. 30nm Silver Nanowire

- 10.1.3. 50nm Silver Nanowire

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Touch Screens

- 10.2.2. OLED Lighting

- 10.2.3. PV Panels

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saint-Gobain

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cambrios

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Carestream

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Blue Nano

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cima NanoTech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ClearJet

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 InkTec

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Innova Dynamics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Seashell Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Novarials

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PlasmaChem

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 3M

- Figure 1: Global Silver Nanowire Transparent Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Silver Nanowire Transparent Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Silver Nanowire Transparent Revenue (million), by Type 2024 & 2032

- Figure 4: North America Silver Nanowire Transparent Volume (K), by Type 2024 & 2032

- Figure 5: North America Silver Nanowire Transparent Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Silver Nanowire Transparent Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Silver Nanowire Transparent Revenue (million), by Application 2024 & 2032

- Figure 8: North America Silver Nanowire Transparent Volume (K), by Application 2024 & 2032

- Figure 9: North America Silver Nanowire Transparent Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Silver Nanowire Transparent Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Silver Nanowire Transparent Revenue (million), by Country 2024 & 2032

- Figure 12: North America Silver Nanowire Transparent Volume (K), by Country 2024 & 2032

- Figure 13: North America Silver Nanowire Transparent Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Silver Nanowire Transparent Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Silver Nanowire Transparent Revenue (million), by Type 2024 & 2032

- Figure 16: South America Silver Nanowire Transparent Volume (K), by Type 2024 & 2032

- Figure 17: South America Silver Nanowire Transparent Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Silver Nanowire Transparent Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Silver Nanowire Transparent Revenue (million), by Application 2024 & 2032

- Figure 20: South America Silver Nanowire Transparent Volume (K), by Application 2024 & 2032

- Figure 21: South America Silver Nanowire Transparent Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Silver Nanowire Transparent Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Silver Nanowire Transparent Revenue (million), by Country 2024 & 2032

- Figure 24: South America Silver Nanowire Transparent Volume (K), by Country 2024 & 2032

- Figure 25: South America Silver Nanowire Transparent Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Silver Nanowire Transparent Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Silver Nanowire Transparent Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Silver Nanowire Transparent Volume (K), by Type 2024 & 2032

- Figure 29: Europe Silver Nanowire Transparent Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Silver Nanowire Transparent Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Silver Nanowire Transparent Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Silver Nanowire Transparent Volume (K), by Application 2024 & 2032

- Figure 33: Europe Silver Nanowire Transparent Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Silver Nanowire Transparent Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Silver Nanowire Transparent Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Silver Nanowire Transparent Volume (K), by Country 2024 & 2032

- Figure 37: Europe Silver Nanowire Transparent Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Silver Nanowire Transparent Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Silver Nanowire Transparent Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Silver Nanowire Transparent Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Silver Nanowire Transparent Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Silver Nanowire Transparent Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Silver Nanowire Transparent Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Silver Nanowire Transparent Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Silver Nanowire Transparent Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Silver Nanowire Transparent Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Silver Nanowire Transparent Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Silver Nanowire Transparent Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Silver Nanowire Transparent Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Silver Nanowire Transparent Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Silver Nanowire Transparent Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Silver Nanowire Transparent Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Silver Nanowire Transparent Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Silver Nanowire Transparent Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Silver Nanowire Transparent Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Silver Nanowire Transparent Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Silver Nanowire Transparent Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Silver Nanowire Transparent Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Silver Nanowire Transparent Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Silver Nanowire Transparent Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Silver Nanowire Transparent Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Silver Nanowire Transparent Volume Share (%), by Country 2024 & 2032

- Table 1: Global Silver Nanowire Transparent Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Silver Nanowire Transparent Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Silver Nanowire Transparent Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Silver Nanowire Transparent Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Silver Nanowire Transparent Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Silver Nanowire Transparent Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Silver Nanowire Transparent Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Silver Nanowire Transparent Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Silver Nanowire Transparent Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Silver Nanowire Transparent Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Silver Nanowire Transparent Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Silver Nanowire Transparent Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Silver Nanowire Transparent Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Silver Nanowire Transparent Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Silver Nanowire Transparent Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Silver Nanowire Transparent Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Silver Nanowire Transparent Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Silver Nanowire Transparent Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Silver Nanowire Transparent Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Silver Nanowire Transparent Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Silver Nanowire Transparent Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Silver Nanowire Transparent Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Silver Nanowire Transparent Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Silver Nanowire Transparent Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Silver Nanowire Transparent Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Silver Nanowire Transparent Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Silver Nanowire Transparent Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Silver Nanowire Transparent Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Silver Nanowire Transparent Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Silver Nanowire Transparent Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Silver Nanowire Transparent Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Silver Nanowire Transparent Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Silver Nanowire Transparent Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Silver Nanowire Transparent Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Silver Nanowire Transparent Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Silver Nanowire Transparent Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Silver Nanowire Transparent Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Silver Nanowire Transparent Volume K Forecast, by Country 2019 & 2032

- Table 81: China Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Silver Nanowire Transparent Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Silver Nanowire Transparent Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

What are some drivers contributing to market growth?

.

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

Can you provide examples of recent developments in the market?

undefined

What are the main segments of the Silver Nanowire Transparent?

The market segments include

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

How can I stay updated on further developments or reports in the Silver Nanowire Transparent?

To stay informed about further developments, trends, and reports in the Silver Nanowire Transparent, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silver Nanowire Transparent," which aids in identifying and referencing the specific market segment covered.

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.