Software Asset Management Managed Service

Software Asset Management Managed ServiceSoftware Asset Management Managed Service 2025-2033 Overview: Trends, Competitor Dynamics, and Opportunities

Software Asset Management Managed Service by Application (Large Enterprises (1000+Users), Medium-Sized Enterprise (499-1000 Users), Small Enterprises (1-499Users)), by Type (Cloud-Based, On-Premises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Base Year: 2024

117 Pages

Key Insights

The Software Asset Management (SAM) Managed Services market is experiencing robust growth, driven by increasing complexities in software licensing, heightened regulatory scrutiny, and the rising adoption of cloud-based solutions. The market's expansion is fueled by the need for enterprises of all sizes – from small businesses to large corporations – to optimize their software spending, mitigate compliance risks, and improve overall IT efficiency. The shift towards cloud computing presents both opportunities and challenges, leading to a greater demand for specialized SAM managed services that can navigate the complexities of cloud licensing models and ensure optimal resource allocation. The market is segmented by enterprise size (large, medium, small) and deployment type (cloud-based, on-premises), reflecting the diverse needs and technological landscapes of different organizations. While the on-premises segment currently holds a larger share, the cloud-based segment is projected to witness faster growth due to the increasing prevalence of cloud adoption strategies. Competition is relatively high, with a mix of established IT service providers, specialized SAM vendors, and consulting firms vying for market share. However, the market's overall growth trajectory indicates substantial opportunities for players who can offer comprehensive, cost-effective, and innovative SAM solutions tailored to specific client needs.

The geographical distribution of the SAM Managed Services market reflects global IT spending patterns. North America and Europe currently dominate the market, driven by high software adoption rates and stringent regulatory compliance requirements. However, Asia-Pacific is expected to witness significant growth in the coming years, fueled by increasing digitalization efforts and rising IT budgets in developing economies like India and China. The market's growth is, however, subject to certain restraints, including the initial investment costs associated with implementing SAM solutions, the need for skilled personnel to manage these solutions, and the potential for resistance to change within organizations. Nevertheless, the long-term benefits of optimized software spending, reduced compliance risks, and improved IT efficiency outweigh these challenges, ensuring the continued expansion of the SAM Managed Services market in the foreseeable future. By 2033, significant market expansion is expected, driven primarily by the factors mentioned above.

Software Asset Management Managed Service Trends

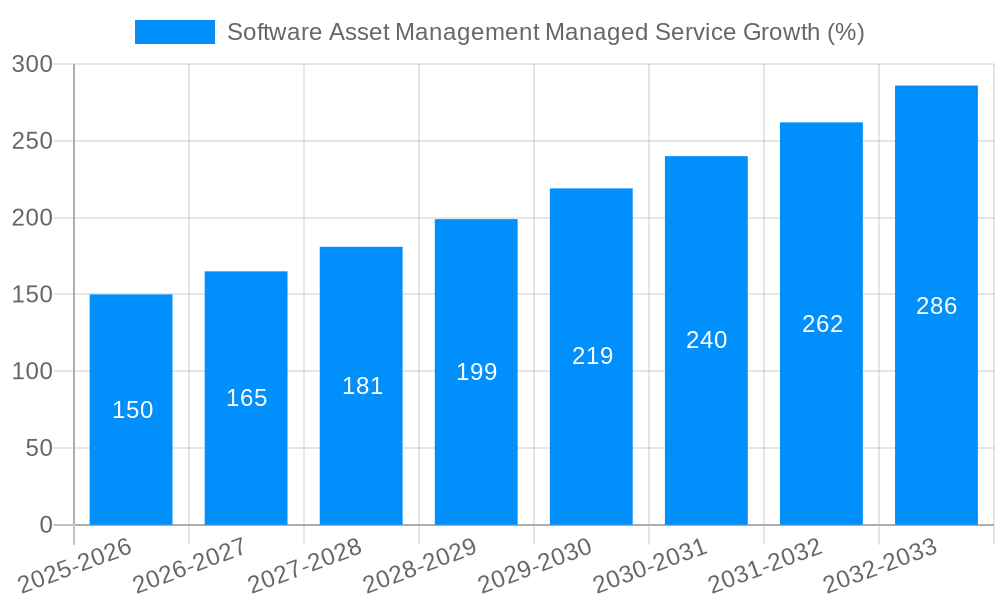

The global Software Asset Management (SAM) Managed Service market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. The study period, encompassing 2019-2033, reveals a consistent upward trajectory, particularly accelerated in recent years. Key market insights indicate a significant shift towards cloud-based solutions, driven by the increasing adoption of cloud computing across various industry verticals. This trend is further amplified by the growing complexity of software licenses and the need for efficient management of increasingly diverse software portfolios. Large enterprises, with their extensive IT infrastructures and complex licensing agreements, are leading the demand for these services. However, medium and small enterprises are rapidly adopting SAM managed services as they recognize the value proposition of cost optimization, risk mitigation, and improved compliance. The estimated market value for 2025 places the SAM Managed Service sector firmly within the multi-million dollar range, with a strong forecast for continued growth throughout the forecast period (2025-2033). This growth is fueled by factors such as rising software expenditure, stringent regulatory compliance requirements, and the escalating need for efficient IT resource management. The historical period (2019-2024) serves as a solid foundation, demonstrating the market's resilience and adaptability to evolving technological landscapes and economic conditions. The base year, 2025, provides a crucial benchmark for analyzing future growth projections and identifying potential market disruptions. This report provides a detailed analysis of these trends and offers valuable insights for stakeholders seeking to capitalize on the opportunities within this rapidly expanding market.

Driving Forces: What's Propelling the Software Asset Management Managed Service

Several factors are propelling the growth of the Software Asset Management Managed Service market. The increasing complexity of software licensing agreements, coupled with the rise in cloud-based software deployments, presents significant challenges for organizations trying to manage their software assets effectively. This complexity leads to increased risk of non-compliance, potential financial penalties, and operational inefficiencies. SAM managed services provide a solution by offering expertise in navigating this complex landscape. The cost savings generated through optimized software license utilization are a major driver. By identifying and rectifying over-licensing, under-licensing, and other inefficiencies, organizations can significantly reduce their software expenditure. Furthermore, the growing focus on regulatory compliance, particularly around software licensing, is forcing organizations to adopt robust SAM practices. Non-compliance can lead to hefty fines and reputational damage, making compliance a key priority. Finally, the increasing adoption of cloud computing and the shift towards hybrid IT environments have added to the demand for advanced SAM solutions capable of managing software across diverse platforms. The need for improved visibility and control over software assets across the entire organization is another significant factor driving the demand for SAM managed services.

Challenges and Restraints in Software Asset Management Managed Service

Despite the significant growth potential, the Software Asset Management Managed Service market faces several challenges and restraints. One major hurdle is the high initial investment required to implement a comprehensive SAM solution. This can be particularly challenging for small and medium-sized enterprises with limited budgets. Integration complexities with existing IT infrastructure can also hinder adoption. Successfully integrating a SAM managed service requires careful planning and execution to avoid disruption to existing workflows. Finding and retaining skilled personnel with expertise in SAM is another significant challenge. The specialized nature of SAM requires professionals with deep knowledge of software licensing, IT infrastructure, and compliance regulations. The lack of awareness about the benefits of SAM managed services among some organizations remains a restraint, particularly in smaller businesses that may not fully understand the long-term value proposition. Competition among established players and new entrants is another factor that could impact market growth. Differentiation and establishing a strong value proposition are key for success in this competitive landscape. Finally, data security and privacy concerns related to the collection and management of sensitive software asset data need careful attention and robust security protocols.

Key Region or Country & Segment to Dominate the Market

The North American market is expected to dominate the Software Asset Management Managed Service sector, followed closely by Europe. This dominance is driven by factors such as higher adoption rates of cloud-based technologies, stringent regulatory compliance requirements, and the presence of several major technology companies. Within the segment breakdown, Large Enterprises (1000+ users) will represent the largest market share, fueled by their complex IT environments and the significant cost savings achievable through optimized software license management. The increasing complexity of software landscapes and the rising costs of compliance are key drivers in this segment.

Large Enterprises (1000+ Users): This segment exhibits the highest demand due to complex IT infrastructure and substantial cost savings potential. The need for advanced analytics and comprehensive reporting to manage massive software portfolios contributes significantly to market growth in this area. Stringent compliance regulations within these organizations also drive adoption of SAM solutions.

North America: The high adoption rate of cloud-based services and stringent compliance requirements in the region create significant demand for SAM managed services. The presence of several technology giants further contributes to its market leadership.

Europe: Similar to North America, Europe witnesses high demand due to rising compliance concerns and a growing awareness of the benefits of optimizing software costs.

The high cost of implementation and integration might hinder the growth of this segment among small and medium-sized enterprises. However, the increasing awareness of the long-term benefits and the emergence of cost-effective solutions are slowly bridging this gap. The cloud-based segment is also poised for significant growth as more organizations migrate their IT infrastructure to the cloud. This transition necessitates effective management of software assets across multiple cloud platforms, fueling the demand for cloud-based SAM managed services.

Growth Catalysts in Software Asset Management Managed Service Industry

The Software Asset Management Managed Service industry is experiencing significant growth driven by several key catalysts. The increasing adoption of cloud computing and the growing complexity of software licensing agreements are major factors, compelling organizations to seek professional management solutions. Rising regulatory pressures and the need to enhance compliance with software licensing regulations are also driving demand. Finally, the potential for significant cost savings through optimized license utilization is a powerful incentive for organizations to invest in these services.

Leading Players in the Software Asset Management Managed Service

- Anglepoint

- Certero

- IT Asset Management Solutions

- B-lay

- TMG

- Business Continuity Services (BCS)

- Derive Logic

- Elee

- Aspera

- Bytes Technology Group

- Crayon

- Deloitte

Significant Developments in Software Asset Management Managed Service Sector

- 2020: Increased focus on cloud-based SAM solutions due to the rapid growth of cloud adoption.

- 2021: Several major players announced strategic partnerships to expand their SAM offerings.

- 2022: Growing adoption of AI and machine learning in SAM to automate license optimization and compliance processes.

- 2023: Enhanced focus on data security and privacy within SAM solutions.

- 2024: Emergence of new SAM platforms integrating with broader IT management tools.

Comprehensive Coverage Software Asset Management Managed Service Report

This report provides a comprehensive overview of the Software Asset Management Managed Service market, encompassing trends, drivers, challenges, key players, and future projections. It offers valuable insights for businesses seeking to leverage SAM services to optimize software spending, enhance compliance, and improve overall IT efficiency. The detailed analysis of market segments, regional trends, and key developments provides a clear picture of this rapidly evolving landscape.

Software Asset Management Managed Service Segmentation

-

1. Application

- 1.1. Large Enterprises (1000+Users)

- 1.2. Medium-Sized Enterprise (499-1000 Users)

- 1.3. Small Enterprises (1-499Users)

-

2. Type

- 2.1. Cloud-Based

- 2.2. On-Premises

Software Asset Management Managed Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Software Asset Management Managed Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Table Of Content

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Software Asset Management Managed Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises (1000+Users)

- 5.1.2. Medium-Sized Enterprise (499-1000 Users)

- 5.1.3. Small Enterprises (1-499Users)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-Based

- 5.2.2. On-Premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Software Asset Management Managed Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises (1000+Users)

- 6.1.2. Medium-Sized Enterprise (499-1000 Users)

- 6.1.3. Small Enterprises (1-499Users)

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud-Based

- 6.2.2. On-Premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Software Asset Management Managed Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises (1000+Users)

- 7.1.2. Medium-Sized Enterprise (499-1000 Users)

- 7.1.3. Small Enterprises (1-499Users)

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud-Based

- 7.2.2. On-Premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Software Asset Management Managed Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises (1000+Users)

- 8.1.2. Medium-Sized Enterprise (499-1000 Users)

- 8.1.3. Small Enterprises (1-499Users)

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud-Based

- 8.2.2. On-Premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Software Asset Management Managed Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises (1000+Users)

- 9.1.2. Medium-Sized Enterprise (499-1000 Users)

- 9.1.3. Small Enterprises (1-499Users)

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud-Based

- 9.2.2. On-Premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Software Asset Management Managed Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises (1000+Users)

- 10.1.2. Medium-Sized Enterprise (499-1000 Users)

- 10.1.3. Small Enterprises (1-499Users)

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud-Based

- 10.2.2. On-Premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Anglepoint

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Certero

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IT Asset Management Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 B-lay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TMG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Business Continuity Services (BCS)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Derive Logic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Elee

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aspera

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bytes Technology Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Crayon

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Deloitte

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Anglepoint

List of Figures

- Figure 1: Global Software Asset Management Managed Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Software Asset Management Managed Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Software Asset Management Managed Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Software Asset Management Managed Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Software Asset Management Managed Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Software Asset Management Managed Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Software Asset Management Managed Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Software Asset Management Managed Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Software Asset Management Managed Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Software Asset Management Managed Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Software Asset Management Managed Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Software Asset Management Managed Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Software Asset Management Managed Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Software Asset Management Managed Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Software Asset Management Managed Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Software Asset Management Managed Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Software Asset Management Managed Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Software Asset Management Managed Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Software Asset Management Managed Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Software Asset Management Managed Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Software Asset Management Managed Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Software Asset Management Managed Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Software Asset Management Managed Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Software Asset Management Managed Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Software Asset Management Managed Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Software Asset Management Managed Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Software Asset Management Managed Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Software Asset Management Managed Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Software Asset Management Managed Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Software Asset Management Managed Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Software Asset Management Managed Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Software Asset Management Managed Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Software Asset Management Managed Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Software Asset Management Managed Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Software Asset Management Managed Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Software Asset Management Managed Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Software Asset Management Managed Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Software Asset Management Managed Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Software Asset Management Managed Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Software Asset Management Managed Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Software Asset Management Managed Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Software Asset Management Managed Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Software Asset Management Managed Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Software Asset Management Managed Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Software Asset Management Managed Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Software Asset Management Managed Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Software Asset Management Managed Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Software Asset Management Managed Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Software Asset Management Managed Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Software Asset Management Managed Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Software Asset Management Managed Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Top-down and bottom-up approaches are used to validate the global market size and estimate the market size for manufactures, regional segemnts, product and application.

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Additionally after gathering mix and scattered data from wide range of sources, data is triangull- ated and correlated to come up with estimated figures which are further validated through primary mediums, or industry experts, opinion leader.

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.