Underwater Inspection Services

Underwater Inspection ServicesUnderwater Inspection Services 2025 to Grow at XX CAGR with XXX million Market Size: Analysis and Forecasts 2033

Underwater Inspection Services by Application (Military, Municipal, Commercial), by Type (Underwater Construction, Underwater Detection, Underwater Equipment Inspection), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global underwater inspection services market is experiencing robust growth, driven by increasing offshore energy exploration, rising demand for infrastructure maintenance, and a growing focus on environmental regulations. The market, estimated at $5 billion in 2025, is projected to exhibit a compound annual growth rate (CAGR) of 7% through 2033, reaching approximately $8.5 billion. This expansion is fueled by several key factors. Firstly, the burgeoning offshore oil and gas industry necessitates regular inspections of pipelines, rigs, and subsea structures to ensure operational safety and prevent environmental damage. Secondly, the aging global infrastructure, particularly ports and bridges, requires continuous monitoring and inspection to prevent costly failures and ensure public safety. Thirdly, stricter environmental regulations are pushing industries to adopt more sophisticated underwater inspection technologies to minimize environmental impact. The market's segmentation reveals significant opportunities across diverse applications, including military, municipal, and commercial sectors, and various inspection types such as underwater construction, detection, and equipment inspection.

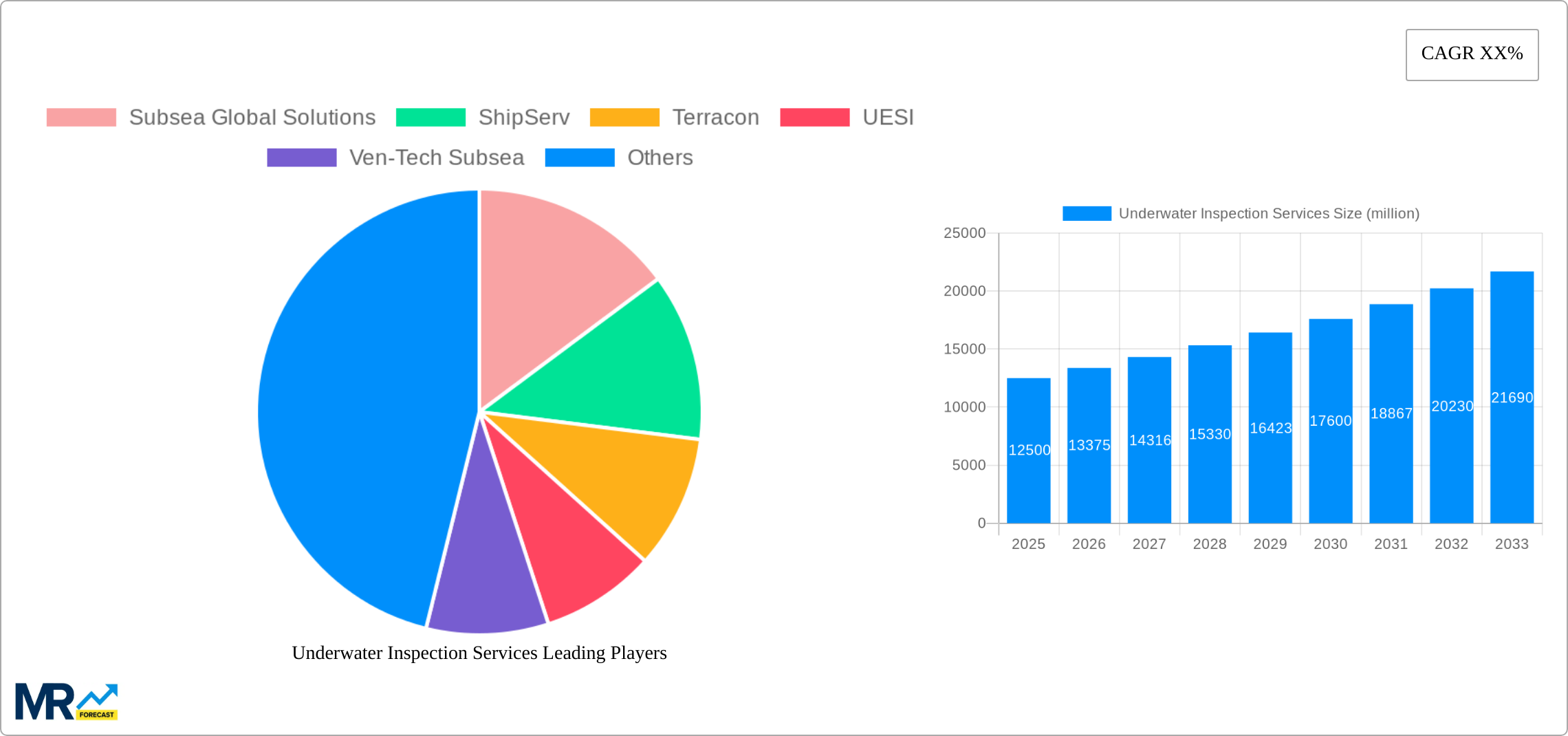

Leading players in this market, such as Oceaneering, Subsea Global Solutions, and MISTRAS, are continuously investing in advanced technologies like remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), and advanced sensor systems. This technological advancement is enhancing inspection accuracy, efficiency, and safety, further bolstering market growth. However, the high initial investment cost of specialized equipment and skilled personnel and the potential challenges posed by harsh underwater environments remain key restraints. Despite these challenges, the expanding scope of underwater infrastructure, coupled with technological innovation and increasing regulatory scrutiny, promises sustained growth and lucrative prospects for companies operating within this sector. Regional analysis indicates North America and Europe currently hold a significant share, but the Asia-Pacific region is expected to witness rapid growth in the coming years, driven by substantial investments in offshore energy and infrastructure projects.

Underwater Inspection Services Trends

The global underwater inspection services market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. Driven by increasing offshore energy exploration, expanding maritime infrastructure, and a heightened focus on asset integrity management, the market demonstrates consistent expansion throughout the study period (2019-2033). The historical period (2019-2024) showcased steady growth, laying the groundwork for the accelerated expansion anticipated during the forecast period (2025-2033). Key market insights reveal a strong demand for advanced underwater inspection technologies, including remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs), which are significantly enhancing inspection efficiency and reducing operational risks. The adoption of these technologies is particularly pronounced within the commercial sector, encompassing offshore oil and gas, renewable energy infrastructure (wind farms), and aquaculture. Further contributing to market growth is the rising awareness of environmental regulations and the need for regular underwater inspections to ensure compliance. This has led to increased investment in sophisticated inspection techniques capable of detecting even minor structural damages or environmental infringements. The estimated market value for 2025 signifies a significant milestone, projecting a substantial increase from the base year figure. This growth is fueled by ongoing investments in infrastructure projects globally and a continued push towards preventative maintenance strategies within various industries. The competitive landscape is dynamic, with numerous companies offering a spectrum of services ranging from basic visual inspections to complex, data-rich analyses utilizing advanced sensor technologies. This competition fosters innovation and drives down costs, making underwater inspection services increasingly accessible to a broader range of clients.

Driving Forces: What's Propelling the Underwater Inspection Services

Several factors contribute to the significant growth trajectory of the underwater inspection services market. Firstly, the burgeoning offshore energy sector, particularly the expanding offshore wind energy industry, necessitates extensive underwater infrastructure inspection for maintenance and safety compliance. This drives demand for specialized inspection services, driving market expansion. Secondly, stricter environmental regulations and a heightened emphasis on asset integrity management are forcing companies across various sectors to prioritize regular underwater inspections. This compliance-driven demand significantly contributes to market growth. Thirdly, advancements in underwater inspection technologies, such as the development of ROVs and AUVs equipped with advanced sensors and AI-powered data analysis capabilities, are enhancing inspection efficiency and providing more detailed, reliable inspection results. This technological advancement makes underwater inspection faster, safer, and more cost-effective. Finally, the increasing availability of skilled personnel trained in underwater inspection techniques, coupled with investments in specialized training programs, ensures a capable workforce to meet the rising demand. The combined effect of these factors fuels the sustained growth and expansion of the underwater inspection services market, pushing it towards impressive valuations in the coming years.

Challenges and Restraints in Underwater Inspection Services

Despite the promising growth outlook, the underwater inspection services market faces several challenges. Firstly, the unpredictable and often harsh underwater environment presents significant operational difficulties and safety risks. Adverse weather conditions, strong currents, and limited visibility can disrupt operations and increase costs. Secondly, the high cost associated with specialized equipment, skilled personnel, and advanced technologies can make underwater inspections expensive, potentially limiting accessibility for smaller companies or projects with limited budgets. Thirdly, the need for highly trained and experienced personnel poses a significant challenge. The specialized nature of underwater inspection requires skilled professionals, and a shortage of qualified personnel can hinder the industry's ability to meet the growing demand. Fourthly, data management and analysis can also present challenges. The large volumes of data generated by modern inspection technologies require advanced software and expertise for effective processing and interpretation. Finally, regulatory compliance across different regions can vary, adding complexity and potential costs to operations. Addressing these challenges through technological innovation, efficient resource management, and enhanced training programs is crucial for ensuring the continued and sustainable growth of the underwater inspection services market.

Key Region or Country & Segment to Dominate the Market

The global underwater inspection services market is geographically diverse, with several regions exhibiting significant growth potential. However, North America and Europe currently hold the largest market shares, driven by the significant presence of offshore oil and gas operations, expanding renewable energy infrastructure (particularly wind farms), and a robust maritime sector. Within these regions, specific countries like the United States, the United Kingdom, and Norway are at the forefront due to their substantial investments in offshore energy and maritime infrastructure projects.

- North America: The US market is leading due to its substantial offshore oil & gas activities and developing offshore wind energy sector.

- Europe: The UK and Norway are key players owing to substantial North Sea oil & gas activities and offshore wind farm development.

- Asia-Pacific: Rapid economic growth and industrialization in countries like China, Japan, and South Korea are driving market expansion, albeit at a slightly slower pace compared to North America and Europe.

In terms of market segmentation, the Commercial application segment currently dominates, propelled by the high demand for underwater inspections within the oil & gas, renewable energy, and maritime industries. Within the Type of service, Underwater Equipment Inspection commands a significant share, due to the crucial need for regular maintenance and safety checks on critical underwater assets. This segment's growth is largely fueled by the stringent regulations mandating frequent inspections of underwater pipelines, cables, and other infrastructure, to ensure operational safety and environmental protection. The increasing complexity and value of these assets further enhance the importance of regular, thorough underwater equipment inspections. The substantial investment in advanced underwater inspection technologies also boosts this segment's prominence within the overall market.

Growth Catalysts in Underwater Inspection Services Industry

Several factors are acting as key catalysts for growth in the underwater inspection services industry. Firstly, the ongoing increase in investments for offshore wind energy projects globally is creating significant demand for underwater inspection services to maintain the integrity of subsea cables and foundations. Secondly, stringent environmental regulations are compelling companies to conduct regular inspections for compliance, driving market expansion. Thirdly, advancements in underwater robotics and sensor technologies are enabling more efficient, cost-effective, and detailed underwater inspections, fueling the industry's rapid growth.

Leading Players in the Underwater Inspection Services

- Subsea Global Solutions

- ShipServ

- Terracon

- UESI

- Ven-Tech Subsea

- US Underwater

- Underwater Construction Corporation

- SeaTec

- MISTRAS

- American Underwater Services, Inc.

- Midco Diving

- Recon Aerial

- Wärtsilä

- ASI Group

- Specialty Underwater Services

- Oceaneering [Oceaneering]

- Explorer Underwater Services

- Triton Diving Services Ltd

Significant Developments in Underwater Inspection Services Sector

- 2020: Several companies invested heavily in AI-powered data analytics for underwater inspection data processing.

- 2021: Increased adoption of ROVs and AUVs with enhanced sensor capabilities.

- 2022: Several new partnerships formed between technology providers and service companies.

- 2023: Significant investments in training programs for specialized underwater inspection personnel.

- 2024: Introduction of new regulations impacting underwater inspection procedures in several key markets.

Comprehensive Coverage Underwater Inspection Services Report

This report provides a thorough analysis of the underwater inspection services market, encompassing historical data, current market dynamics, and future projections. It offers a detailed segmentation by application (Military, Municipal, Commercial), type (Underwater Construction, Underwater Detection, Underwater Equipment Inspection), and geographic region, offering comprehensive insights into market trends and opportunities. The report identifies key growth drivers, challenges, and significant market players, providing valuable information for stakeholders across the industry. The forecast period extends to 2033, offering a long-term perspective on the market's development.

Underwater Inspection Services Segmentation

-

1. Application

- 1.1. Military

- 1.2. Municipal

- 1.3. Commercial

-

2. Type

- 2.1. Underwater Construction

- 2.2. Underwater Detection

- 2.3. Underwater Equipment Inspection

Underwater Inspection Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Underwater Inspection Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

How can I stay updated on further developments or reports in the Underwater Inspection Services?

To stay informed about further developments, trends, and reports in the Underwater Inspection Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

What is the projected Compound Annual Growth Rate (CAGR) of the Underwater Inspection Services ?

The projected CAGR is approximately XX%.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

Can you provide examples of recent developments in the market?

undefined

What are the notable trends driving market growth?

.

What are some drivers contributing to market growth?

.

Which companies are prominent players in the Underwater Inspection Services?

Key companies in the market include Subsea Global Solutions,ShipServ,Terracon,UESI,Ven-Tech Subsea,US Underwater,Underwater Construction Corporation,SeaTec,MISTRAS,American Underwater Services,Inc.,Midco Diving,Recon Aerial,Wärtsilä,ASI Group,Specialty Underwater Services,Oceaneering,Explorer Underwater Services,Triton Diving Services Ltd,

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Underwater Inspection Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military

- 5.1.2. Municipal

- 5.1.3. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Underwater Construction

- 5.2.2. Underwater Detection

- 5.2.3. Underwater Equipment Inspection

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Underwater Inspection Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military

- 6.1.2. Municipal

- 6.1.3. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Underwater Construction

- 6.2.2. Underwater Detection

- 6.2.3. Underwater Equipment Inspection

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Underwater Inspection Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military

- 7.1.2. Municipal

- 7.1.3. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Underwater Construction

- 7.2.2. Underwater Detection

- 7.2.3. Underwater Equipment Inspection

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Underwater Inspection Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military

- 8.1.2. Municipal

- 8.1.3. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Underwater Construction

- 8.2.2. Underwater Detection

- 8.2.3. Underwater Equipment Inspection

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Underwater Inspection Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military

- 9.1.2. Municipal

- 9.1.3. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Underwater Construction

- 9.2.2. Underwater Detection

- 9.2.3. Underwater Equipment Inspection

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Underwater Inspection Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military

- 10.1.2. Municipal

- 10.1.3. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Underwater Construction

- 10.2.2. Underwater Detection

- 10.2.3. Underwater Equipment Inspection

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Subsea Global Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ShipServ

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Terracon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 UESI

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ven-Tech Subsea

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 US Underwater

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Underwater Construction Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SeaTec

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MISTRAS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 American Underwater ServicesInc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Midco Diving

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Recon Aerial

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wärtsilä

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ASI Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Specialty Underwater Services

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Oceaneering

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Explorer Underwater Services

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Triton Diving Services Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Subsea Global Solutions

- Figure 1: Global Underwater Inspection Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Underwater Inspection Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Underwater Inspection Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Underwater Inspection Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Underwater Inspection Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Underwater Inspection Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Underwater Inspection Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Underwater Inspection Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Underwater Inspection Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Underwater Inspection Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Underwater Inspection Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Underwater Inspection Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Underwater Inspection Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Underwater Inspection Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Underwater Inspection Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Underwater Inspection Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Underwater Inspection Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Underwater Inspection Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Underwater Inspection Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Underwater Inspection Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Underwater Inspection Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Underwater Inspection Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Underwater Inspection Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Underwater Inspection Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Underwater Inspection Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Underwater Inspection Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Underwater Inspection Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Underwater Inspection Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Underwater Inspection Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Underwater Inspection Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Underwater Inspection Services Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Underwater Inspection Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Underwater Inspection Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Underwater Inspection Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Underwater Inspection Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Underwater Inspection Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Underwater Inspection Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Underwater Inspection Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Underwater Inspection Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Underwater Inspection Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Underwater Inspection Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Underwater Inspection Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Underwater Inspection Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Underwater Inspection Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Underwater Inspection Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Underwater Inspection Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Underwater Inspection Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Underwater Inspection Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Underwater Inspection Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Underwater Inspection Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Underwater Inspection Services Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.