Valuable Articles Insurance

Valuable Articles InsuranceValuable Articles Insurance 2025-2033 Analysis: Trends, Competitor Dynamics, and Growth Opportunities

Valuable Articles Insurance by Type (Personal Insurance, Business Insurance), by Application (Collection, Jewelry, Artwork, Wine and Liquor, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

Valuable Articles Insurance Market Overview:

The global Valuable Articles Insurance market is projected to reach a value of approximately USD 36 billion by 2033, expanding at a CAGR of over 7% between 2025 and 2033. Growing awareness of protecting high-value assets such as jewelry, artwork, and collectibles, coupled with the increasing prevalence of art and artifact exhibitions, is primarily driving the market growth. Moreover, the rising number of high-net-worth individuals and the increasing demand for specialized insurance coverage for valuable assets are further contributing to the market's expansion.

Market Segments and Regional Analysis:

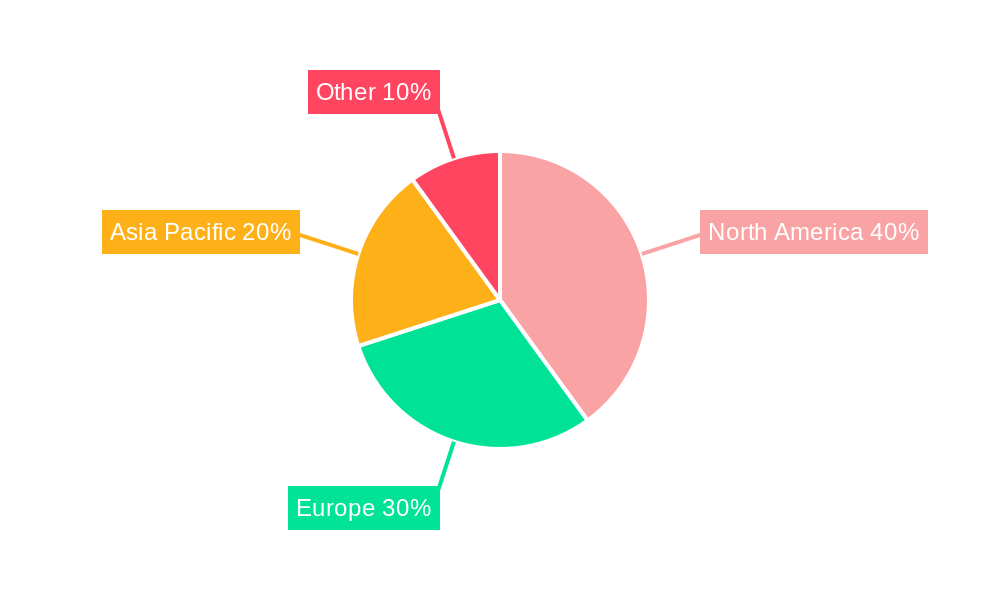

The Valuable Articles Insurance market is segmented into types (Personal Insurance and Business Insurance) and applications (Collection, Jewelry, Artwork, Wine and Liquor, and Other). Regional analysis reveals that North America held the dominant market share in 2023, primarily due to the presence of a significant number of high-net-worth individuals and the increasing demand for luxury and collectible items in the region. Asia Pacific is anticipated to witness substantial growth over the forecast period, driven by the rapidly growing affluent population and the increasing demand for specialized insurance coverage in emerging economies like China and India.

Valuable Articles Insurance Trends**

The global valuable articles insurance market has witnessed steady growth over the past few years due to rising affluence and increased demand for luxury goods, including jewelry, fine art, and collectibles. According to a report by Grand View Research, the market is projected to reach $30.5 billion by 2028. This growth is driven by robust demand from developed regions such as North America and Europe, as well as increasing adoption in emerging markets.

Key market insights include:

*Growing demand for tailored insurance policies that cater to specific needs of collectors and enthusiasts. *Increasing awareness of the importance of protecting valuable possessions against theft, damage, and loss. *Expansion of the art and collectibles market, fueled by growing interest in alternative investments. *Advancements in technology, such as remote appraisal and digital inventory management systems, are enhancing convenience and efficiency for policyholders.

Driving Forces: What's Propelling the Valuable Articles Insurance**

The growth of the valuable articles insurance market is propelled by several key driving forces, including:

- Increasing Affluence:Rising disposable income levels in many developed and emerging economies have led to a growing demand for luxury goods and collectibles. This has fueled the need for specialized insurance solutions to protect these valuable assets.

- Globalization and Trade:Increased cross-border trade of art, antiques, and other valuables has created a global demand for insurance coverage that accommodates international transportation and storage.

- Demographic Shifts:The aging population in many developed countries has resulted in a growing number of individuals looking to preserve and protect their family heirlooms and valuable possessions.

- Rise of the Middle Class:In emerging markets, the growing middle class is developing a taste for luxury goods and collectibles, driving demand for insurance to safeguard these investments.

Challenges and Restraints in Valuable Articles Insurance**

Despite the growth opportunities, the valuable articles insurance market faces certain challenges and restraints:

- Underinsurance:Many collectors and enthusiasts may underestimate the value of their collections, leading to inadequate insurance coverage in the event of a loss.

- Fraud and Theft:The high value of valuable articles makes them targets for theft, fraud, and counterfeiting, posing challenges for insurers in assessing risk and mitigating losses.

- Catastrophic Events:Natural disasters, accidents, and other catastrophic events can cause significant losses to valuable collections, making it crucial for insurers to have robust risk management plans in place.

- Lack of Standardized Valuation Methods:The valuation of valuable articles can be subjective and complex, leading to disputes between policyholders and insurers regarding the appropriate coverage levels.

Key Region or Country & Segment to Dominate the Market**

Key Region:

- North America is expected to dominate the global valuable articles insurance market due to its high concentration of affluent individuals, prominent art market, and advanced insurance industry.

Key Segment:

- Jewelry: The jewelry segment is anticipated to hold the largest market share due to its high value and susceptibility to theft and loss.

- Artwork: The artwork segment is also expected to witness significant growth as collectors and investors increasingly seek to diversify their portfolios with valuable art pieces.

Growth Catalysts in Valuable Articles Insurance Industry**

Several factors are expected to drive the growth of the valuable articles insurance industry in the coming years:

- Technological Advancements: Innovations in technology, such as blockchain and artificial intelligence, can enhance risk assessment, underwriting processes, and fraud detection.

- Focus on Personalization: Insurers are increasingly offering tailored insurance policies that meet the specific needs and preferences of collectors and enthusiasts.

- Expansion into Emerging Markets: The growing affluence and demand for luxury goods in emerging markets present significant growth opportunities for valuable articles insurance providers.

- Increasing Awareness: Educational campaigns and initiatives by industry players are raising awareness about the importance of valuable articles insurance, driving demand for coverage.

Leading Players in the Valuable Articles Insurance**

- Allianz

- Allstate

- Berliner Gelfand Insurance

- Chubb

- Daigle and Travers

- Huntington

- Muller Insurance

- Orchid Insurance

- PICC

- The Hanover Insurance Group

- The Hartford

- Zurich

- Levitt Fuirst

- State Farm

- Arthur Hall Insurance

Significant Developments in Valuable Articles Insurance Sector**

- Insurance companies are partnering with art galleries and auction houses to offer specialized insurance solutions for high-value artworks.

- Insurers are developing comprehensive policies that cover not only physical damage but also loss of value due to factors such as market fluctuations or authenticity disputes.

- The use of technology is transforming the industry, with insurers leveraging data analytics, artificial intelligence, and blockchain to enhance risk assessment and underwriting processes.

Valuable Articles Insurance Segmentation

-

1. Type

- 1.1. Personal Insurance

- 1.2. Business Insurance

-

2. Application

- 2.1. Collection

- 2.2. Jewelry

- 2.3. Artwork

- 2.4. Wine and Liquor

- 2.5. Other

Valuable Articles Insurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Valuable Articles Insurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

Can you provide examples of recent developments in the market?

undefined

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00 , USD 6720.00, and USD 8960.00 respectively.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

What are the main segments of the Valuable Articles Insurance?

The market segments include

What are the notable trends driving market growth?

.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Valuable Articles Insurance," which aids in identifying and referencing the specific market segment covered.

What are some drivers contributing to market growth?

.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Valuable Articles Insurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Personal Insurance

- 5.1.2. Business Insurance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Collection

- 5.2.2. Jewelry

- 5.2.3. Artwork

- 5.2.4. Wine and Liquor

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Valuable Articles Insurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Personal Insurance

- 6.1.2. Business Insurance

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Collection

- 6.2.2. Jewelry

- 6.2.3. Artwork

- 6.2.4. Wine and Liquor

- 6.2.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Valuable Articles Insurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Personal Insurance

- 7.1.2. Business Insurance

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Collection

- 7.2.2. Jewelry

- 7.2.3. Artwork

- 7.2.4. Wine and Liquor

- 7.2.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Valuable Articles Insurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Personal Insurance

- 8.1.2. Business Insurance

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Collection

- 8.2.2. Jewelry

- 8.2.3. Artwork

- 8.2.4. Wine and Liquor

- 8.2.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Valuable Articles Insurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Personal Insurance

- 9.1.2. Business Insurance

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Collection

- 9.2.2. Jewelry

- 9.2.3. Artwork

- 9.2.4. Wine and Liquor

- 9.2.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Valuable Articles Insurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Personal Insurance

- 10.1.2. Business Insurance

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Collection

- 10.2.2. Jewelry

- 10.2.3. Artwork

- 10.2.4. Wine and Liquor

- 10.2.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Allianz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Allstate

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Berliner Gelfand Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chubb

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daigle and Travers

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huntington

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Muller Insurance

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Orchid Insurance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PICC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Hanover Insurance Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Hartford

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Zurich

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Levitt Fuirst

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 State Farm

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Arthur Hall Insurance

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Allianz

- Figure 1: Global Valuable Articles Insurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Valuable Articles Insurance Revenue (million), by Type 2024 & 2032

- Figure 3: North America Valuable Articles Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Valuable Articles Insurance Revenue (million), by Application 2024 & 2032

- Figure 5: North America Valuable Articles Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Valuable Articles Insurance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Valuable Articles Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Valuable Articles Insurance Revenue (million), by Type 2024 & 2032

- Figure 9: South America Valuable Articles Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Valuable Articles Insurance Revenue (million), by Application 2024 & 2032

- Figure 11: South America Valuable Articles Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Valuable Articles Insurance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Valuable Articles Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Valuable Articles Insurance Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Valuable Articles Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Valuable Articles Insurance Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Valuable Articles Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Valuable Articles Insurance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Valuable Articles Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Valuable Articles Insurance Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Valuable Articles Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Valuable Articles Insurance Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Valuable Articles Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Valuable Articles Insurance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Valuable Articles Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Valuable Articles Insurance Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Valuable Articles Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Valuable Articles Insurance Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Valuable Articles Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Valuable Articles Insurance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Valuable Articles Insurance Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Valuable Articles Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Valuable Articles Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Valuable Articles Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Valuable Articles Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Valuable Articles Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Valuable Articles Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Valuable Articles Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Valuable Articles Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Valuable Articles Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Valuable Articles Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Valuable Articles Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Valuable Articles Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Valuable Articles Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Valuable Articles Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Valuable Articles Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Valuable Articles Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Valuable Articles Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Valuable Articles Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Valuable Articles Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Valuable Articles Insurance Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.