Vertical Automatic Cartoning Machines

Vertical Automatic Cartoning MachinesVertical Automatic Cartoning Machines 2025-2033 Analysis: Trends, Competitor Dynamics, and Growth Opportunities

Vertical Automatic Cartoning Machines by Type (End Load Cartoners, Top Load Cartoners), by Application (Food & Beverage, Personal Care, Pharmaceutical, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global vertical automatic cartoning machine market is experiencing robust growth, driven by increasing automation in the food and beverage, pharmaceutical, and personal care industries. The demand for high-speed, efficient packaging solutions is a primary catalyst, coupled with the need for enhanced product protection and reduced labor costs. The market is segmented by cartoner type (end-load and top-load) and application, with food and beverage currently holding the largest share, followed by pharmaceuticals and personal care. This is largely due to the high volume production requirements in these sectors. Technological advancements, such as improved machine vision systems and integration with other packaging equipment, further contribute to market expansion. However, high initial investment costs and the need for skilled technicians to operate and maintain these machines present some challenges to market growth. The competitive landscape is characterized by a mix of large multinational corporations and specialized regional players, resulting in intense competition and a focus on innovation and product differentiation. The market is expected to witness a steady expansion over the forecast period (2025-2033), with a projected CAGR of approximately 5-7% (this is an estimation based on typical growth in automated packaging machinery markets; specific CAGR data was not provided).

Regional variations exist, with North America and Europe currently holding significant market shares due to established manufacturing sectors and higher adoption rates of automation technologies. However, Asia-Pacific is poised for significant growth owing to rapid industrialization and expanding consumer goods markets in countries like China and India. The market will likely see increasing adoption of advanced features such as robotic integration, improved sanitation capabilities to meet stricter hygiene standards, and greater focus on sustainable packaging materials. This trend towards advanced features and sustainable solutions will further shape the competitive dynamics, driving innovation and pushing manufacturers to provide more cost-effective and environmentally friendly solutions. Furthermore, the increasing prevalence of e-commerce and the resulting demand for efficient order fulfillment will further boost market demand.

Vertical Automatic Cartoning Machines Trends

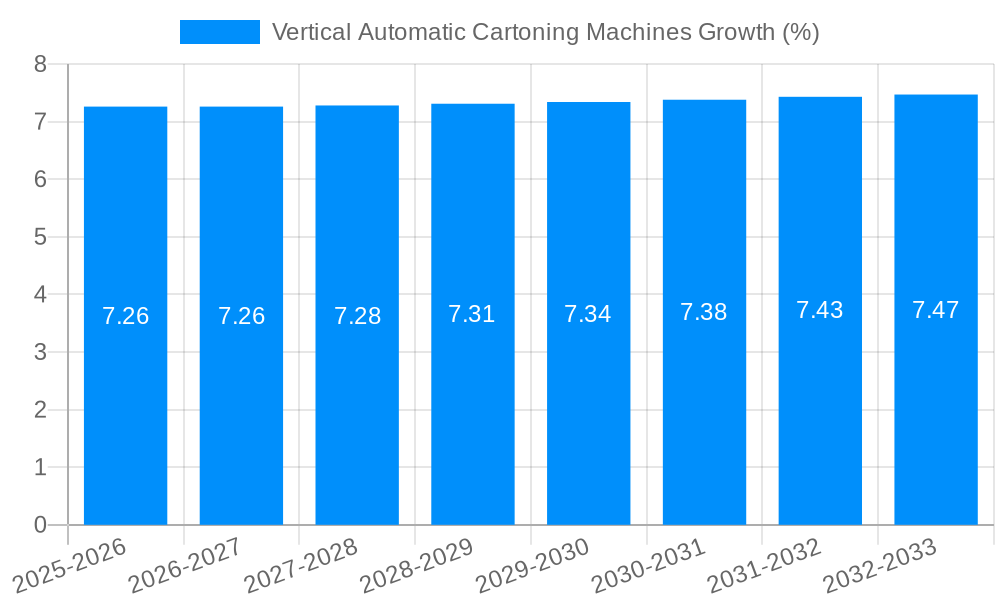

The global vertical automatic cartoning machines market is experiencing robust growth, projected to reach several billion units by 2033. Driven by increasing automation across various industries and the demand for high-speed, efficient packaging solutions, this market segment shows significant potential. The historical period (2019-2024) witnessed steady expansion, primarily fueled by the pharmaceutical and food & beverage sectors. However, the forecast period (2025-2033) anticipates even more accelerated growth, propelled by several factors including the rising adoption of e-commerce, the need for enhanced product protection, and stringent regulatory compliance requirements within the pharmaceutical industry. The estimated market value for 2025 is already substantial, reflecting the current demand and the industry's transition towards sophisticated, automated packaging lines. Key market insights reveal a strong preference for flexible and adaptable cartoning machines capable of handling diverse product formats and packaging materials. This trend is particularly evident in the pharmaceutical sector, where customization and product traceability are paramount. Furthermore, the increasing emphasis on sustainability is influencing machine design, with manufacturers focusing on energy-efficient models and eco-friendly materials. The competition among key players is intensifying, leading to innovations in machine speed, precision, and integration with upstream and downstream packaging equipment. This competitive landscape benefits consumers through better product quality, enhanced efficiency, and a wider range of choices in cartoning solutions. The market is witnessing a shift towards smart packaging solutions, where machines can be integrated with digital systems for real-time monitoring and data analytics, further enhancing efficiency and reducing downtime.

Driving Forces: What's Propelling the Vertical Automatic Cartoning Machines

Several factors are propelling the growth of the vertical automatic cartoning machines market. Firstly, the escalating demand for automated packaging solutions across industries like food and beverage, pharmaceuticals, and personal care is a primary driver. Manufacturers are increasingly prioritizing speed, precision, and efficiency in their packaging lines to meet rising consumer demands and optimize production costs. Secondly, the surge in e-commerce has significantly boosted the need for robust and reliable cartoning machines capable of handling high-volume orders with minimal errors. This sector demands speed and efficiency to keep up with order fulfillment. Thirdly, stringent regulations, especially in the pharmaceutical industry, mandate precise and tamper-evident packaging. Vertical automatic cartoning machines provide an excellent solution, ensuring product safety and regulatory compliance. Finally, ongoing technological advancements are continuously improving the speed, flexibility, and efficiency of these machines. The integration of advanced robotics, sophisticated control systems, and user-friendly interfaces contributes to the market's growth. These advancements are not only enhancing productivity but also reducing labor costs and minimizing product damage during the cartoning process. The increasing adoption of Industry 4.0 principles further enhances efficiency and enables predictive maintenance, resulting in reduced downtime and improved overall equipment effectiveness (OEE).

Challenges and Restraints in Vertical Automatic Cartoning Machines

Despite the significant growth potential, the vertical automatic cartoning machines market faces certain challenges and restraints. High initial investment costs associated with acquiring and implementing these sophisticated machines can be a significant barrier for small and medium-sized enterprises (SMEs). The complexity of these machines also necessitates skilled operators and specialized maintenance personnel, increasing operational costs and potentially hindering adoption by businesses lacking the necessary expertise. Furthermore, the ongoing need for technological upgrades and adaptation to changing product formats and packaging materials can lead to substantial ongoing expenses. The market is also susceptible to fluctuations in raw material prices, impacting the overall cost of manufacturing and potentially affecting profitability. Finally, intense competition among established players and the emergence of new entrants creates a dynamic and sometimes unpredictable market environment. Companies need to constantly innovate and adapt to maintain a competitive edge. The global economic climate, particularly periods of recession or uncertainty, can also impact investment decisions and potentially slow down market growth.

Key Region or Country & Segment to Dominate the Market

The pharmaceutical segment is expected to dominate the vertical automatic cartoning machines market throughout the forecast period. The stringent regulatory requirements within the pharmaceutical industry mandate highly precise and traceable packaging processes. Vertical automatic cartoning machines perfectly fulfill this need, offering features such as tamper-evident seals and accurate batch coding.

- High Demand from Pharmaceutical Companies: This sector places a premium on speed, accuracy, and regulatory compliance. The need to minimize errors and ensure product integrity fuels the high demand for these machines.

- Stringent Regulatory Compliance: Pharmaceutical regulations are constantly evolving. These machines are designed to meet these changing standards, offering functionalities such as serialisation and track-and-trace capabilities.

- Growing Investment in Automation: Pharmaceutical companies are increasingly investing in automated packaging solutions to enhance efficiency, reduce operational costs, and improve overall production output.

- Technological Advancements: The continuous improvement of machine technology, including the integration of advanced control systems and robotic solutions, is further driving the market's growth within this segment.

- Geographic Distribution: North America and Europe, with their established pharmaceutical industries and advanced technological infrastructure, are anticipated to represent significant market shares. However, the Asia-Pacific region, experiencing rapid growth in the pharmaceutical sector, presents a considerable opportunity for future market expansion.

The Pharmaceutical segment’s dominance stems from the need for high-precision, traceability, and tamper-evidence, all capabilities these machines readily provide. This need combined with significant investment in automation within the industry makes this segment a clear frontrunner. While other sectors like food & beverage also utilize these machines, the regulatory requirements and investment capacity within the pharmaceutical industry ensure its continued dominance.

Growth Catalysts in Vertical Automatic Cartoning Machines Industry

Several factors are catalyzing growth in the vertical automatic cartoning machines industry. Increased automation across various manufacturing sectors is a key driver, along with the rising demand for efficient and high-speed packaging solutions. Stringent regulatory requirements, particularly within pharmaceuticals, mandate advanced packaging technologies, directly boosting the market for these machines. The rise of e-commerce further fuels demand, requiring high-throughput packaging to meet online order fulfillment needs. Finally, ongoing technological innovations, including improvements in machine design, control systems, and integration capabilities, enhance efficiency and appeal to manufacturers seeking optimal production processes.

Leading Players in the Vertical Automatic Cartoning Machines

- IMA

- Syntegon (Syntegon)

- Körber (Körber)

- ProMach (ProMach)

- IWK

- Mpac (Mpac)

- Truking

- Omori

- PMI Kyoto

- Bradman Lake (Bradman Lake)

- ADCO Manufacturing

- Marchesini (Marchesini)

- LoeschPack

- Hualian

- Fuji Machinery

- Uhlmann (Uhlmann)

- Tofflon

- Econocorp

- Youngsun

- ZAC

- Hoong-A

- Hoping Machinery

Significant Developments in Vertical Automatic Cartoning Machines Sector

- 2020: Introduction of a new high-speed vertical cartoner by Syntegon, incorporating advanced vision systems for improved quality control.

- 2021: IMA launched a sustainable cartoning machine utilizing recycled materials and energy-efficient components.

- 2022: Körber unveiled a fully integrated cartoning line incorporating robotic handling and advanced data analytics capabilities.

- 2023: Several manufacturers announced collaborations focusing on developing Industry 4.0 compatible cartoning machines with enhanced connectivity and data exchange capabilities.

Comprehensive Coverage Vertical Automatic Cartoning Machines Report

This report provides a comprehensive analysis of the global vertical automatic cartoning machines market, covering market trends, growth drivers, challenges, key players, and significant developments. It offers detailed insights into various market segments, including by type (end-load and top-load cartoners) and application (food & beverage, pharmaceutical, personal care, and others). The report further examines regional market dynamics and provides forecasts for the next decade, offering valuable insights for businesses operating in this rapidly evolving sector. The report also includes a competitive landscape analysis, highlighting the strategies and market positions of key players.

Vertical Automatic Cartoning Machines Segmentation

-

1. Type

- 1.1. End Load Cartoners

- 1.2. Top Load Cartoners

-

2. Application

- 2.1. Food & Beverage

- 2.2. Personal Care

- 2.3. Pharmaceutical

- 2.4. Others

Vertical Automatic Cartoning Machines Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Vertical Automatic Cartoning Machines REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vertical Automatic Cartoning Machines Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. End Load Cartoners

- 5.1.2. Top Load Cartoners

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Beverage

- 5.2.2. Personal Care

- 5.2.3. Pharmaceutical

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Vertical Automatic Cartoning Machines Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. End Load Cartoners

- 6.1.2. Top Load Cartoners

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food & Beverage

- 6.2.2. Personal Care

- 6.2.3. Pharmaceutical

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Vertical Automatic Cartoning Machines Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. End Load Cartoners

- 7.1.2. Top Load Cartoners

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food & Beverage

- 7.2.2. Personal Care

- 7.2.3. Pharmaceutical

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Vertical Automatic Cartoning Machines Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. End Load Cartoners

- 8.1.2. Top Load Cartoners

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food & Beverage

- 8.2.2. Personal Care

- 8.2.3. Pharmaceutical

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Vertical Automatic Cartoning Machines Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. End Load Cartoners

- 9.1.2. Top Load Cartoners

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food & Beverage

- 9.2.2. Personal Care

- 9.2.3. Pharmaceutical

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Vertical Automatic Cartoning Machines Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. End Load Cartoners

- 10.1.2. Top Load Cartoners

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food & Beverage

- 10.2.2. Personal Care

- 10.2.3. Pharmaceutical

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IMA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Syntegon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Korber

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ProMach

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IWK

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mpac

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Truking

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Omori

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PMI Kyoto

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bradman Lake

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ADCO Manufacturing

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Marchesini

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LoeschPack

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hualian

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Fuji Machinery

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Uhlmann

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tofflon

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Econocorp

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Youngsun

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 ZAC

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Hoong-A

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Hoping Machinery

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 IMA

- Figure 1: Global Vertical Automatic Cartoning Machines Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Vertical Automatic Cartoning Machines Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Vertical Automatic Cartoning Machines Revenue (million), by Type 2024 & 2032

- Figure 4: North America Vertical Automatic Cartoning Machines Volume (K), by Type 2024 & 2032

- Figure 5: North America Vertical Automatic Cartoning Machines Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Vertical Automatic Cartoning Machines Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Vertical Automatic Cartoning Machines Revenue (million), by Application 2024 & 2032

- Figure 8: North America Vertical Automatic Cartoning Machines Volume (K), by Application 2024 & 2032

- Figure 9: North America Vertical Automatic Cartoning Machines Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Vertical Automatic Cartoning Machines Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Vertical Automatic Cartoning Machines Revenue (million), by Country 2024 & 2032

- Figure 12: North America Vertical Automatic Cartoning Machines Volume (K), by Country 2024 & 2032

- Figure 13: North America Vertical Automatic Cartoning Machines Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Vertical Automatic Cartoning Machines Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Vertical Automatic Cartoning Machines Revenue (million), by Type 2024 & 2032

- Figure 16: South America Vertical Automatic Cartoning Machines Volume (K), by Type 2024 & 2032

- Figure 17: South America Vertical Automatic Cartoning Machines Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Vertical Automatic Cartoning Machines Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Vertical Automatic Cartoning Machines Revenue (million), by Application 2024 & 2032

- Figure 20: South America Vertical Automatic Cartoning Machines Volume (K), by Application 2024 & 2032

- Figure 21: South America Vertical Automatic Cartoning Machines Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Vertical Automatic Cartoning Machines Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Vertical Automatic Cartoning Machines Revenue (million), by Country 2024 & 2032

- Figure 24: South America Vertical Automatic Cartoning Machines Volume (K), by Country 2024 & 2032

- Figure 25: South America Vertical Automatic Cartoning Machines Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Vertical Automatic Cartoning Machines Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Vertical Automatic Cartoning Machines Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Vertical Automatic Cartoning Machines Volume (K), by Type 2024 & 2032

- Figure 29: Europe Vertical Automatic Cartoning Machines Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Vertical Automatic Cartoning Machines Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Vertical Automatic Cartoning Machines Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Vertical Automatic Cartoning Machines Volume (K), by Application 2024 & 2032

- Figure 33: Europe Vertical Automatic Cartoning Machines Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Vertical Automatic Cartoning Machines Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Vertical Automatic Cartoning Machines Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Vertical Automatic Cartoning Machines Volume (K), by Country 2024 & 2032

- Figure 37: Europe Vertical Automatic Cartoning Machines Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Vertical Automatic Cartoning Machines Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Vertical Automatic Cartoning Machines Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Vertical Automatic Cartoning Machines Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Vertical Automatic Cartoning Machines Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Vertical Automatic Cartoning Machines Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Vertical Automatic Cartoning Machines Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Vertical Automatic Cartoning Machines Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Vertical Automatic Cartoning Machines Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Vertical Automatic Cartoning Machines Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Vertical Automatic Cartoning Machines Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Vertical Automatic Cartoning Machines Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Vertical Automatic Cartoning Machines Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Vertical Automatic Cartoning Machines Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Vertical Automatic Cartoning Machines Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Vertical Automatic Cartoning Machines Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Vertical Automatic Cartoning Machines Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Vertical Automatic Cartoning Machines Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Vertical Automatic Cartoning Machines Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Vertical Automatic Cartoning Machines Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Vertical Automatic Cartoning Machines Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Vertical Automatic Cartoning Machines Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Vertical Automatic Cartoning Machines Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Vertical Automatic Cartoning Machines Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Vertical Automatic Cartoning Machines Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Vertical Automatic Cartoning Machines Volume Share (%), by Country 2024 & 2032

- Table 1: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Vertical Automatic Cartoning Machines Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Vertical Automatic Cartoning Machines Volume K Forecast, by Country 2019 & 2032

- Table 81: China Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Vertical Automatic Cartoning Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Vertical Automatic Cartoning Machines Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.