Virtual Fitting Tools

Virtual Fitting ToolsVirtual Fitting Tools Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

Virtual Fitting Tools by Type (Cloud-Based, Web-Based), by Application (Enterprises, Individuals), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

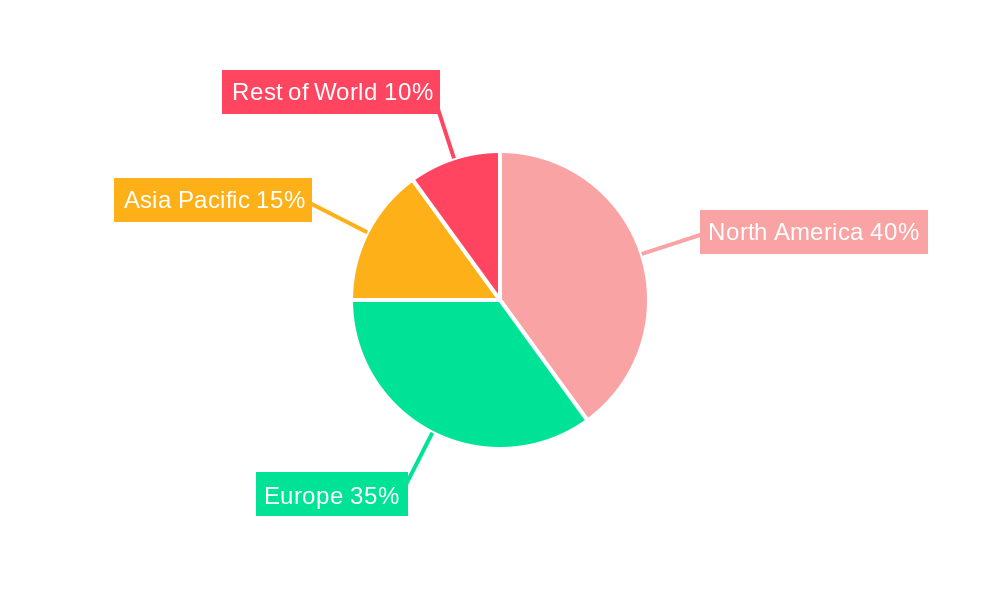

The virtual fitting tools market is experiencing robust growth, driven by the increasing adoption of e-commerce and a rising demand for personalized shopping experiences. Consumers are increasingly seeking convenient and accurate ways to try on clothes and accessories online before purchasing, eliminating the uncertainties associated with traditional online shopping. This has fueled the demand for sophisticated virtual fitting technologies, ranging from basic size guides to advanced 3D body scanners and augmented reality (AR) applications. The market's expansion is further propelled by technological advancements in computer vision, AI, and 3D modeling, enabling more realistic and immersive virtual fitting experiences. While the cloud-based segment currently dominates due to scalability and accessibility, the web-based segment is expected to see significant growth driven by its ease of integration into existing e-commerce platforms. Enterprises are the primary adopters, leveraging these tools to enhance customer satisfaction, reduce returns, and improve sales conversion rates. However, challenges remain in accurately representing diverse body types and sizes, requiring further technological refinement and data collection to achieve broader inclusivity. The market is fragmented, with numerous players offering varied solutions, ranging from specialized body measurement tools to comprehensive virtual styling platforms. Competition is intensifying as established players and emerging startups strive to enhance their technology and expand their market reach geographically. The North American market currently holds the largest share due to early adoption and a high concentration of e-commerce businesses. However, Asia-Pacific is anticipated to witness substantial growth in the coming years fueled by rising internet penetration and a booming e-commerce sector in countries like China and India.

The forecast period (2025-2033) projects continued expansion, with a compounded annual growth rate (CAGR) likely exceeding 15%. This growth will be driven by increasing smartphone penetration, improvements in AR/VR technology resulting in more realistic virtual try-ons, and a wider adoption of virtual fitting tools by smaller businesses. The market will witness consolidation as larger companies acquire smaller players, leading to increased market concentration. Further technological advancements, such as personalized recommendations and integration with social media platforms, will drive further growth and adoption. Key players will need to focus on innovation, providing accurate and user-friendly interfaces, and expanding their product offerings to maintain competitiveness. Addressing the challenges of accurate sizing for diverse body types remains crucial for long-term market success.

Virtual Fitting Tools Trends

The virtual fitting tools market is experiencing explosive growth, projected to reach multi-million unit sales within the forecast period (2025-2033). Driven by advancements in augmented reality (AR), artificial intelligence (AI), and 3D modeling, the market is transforming how consumers shop for clothing, footwear, and accessories. The historical period (2019-2024) saw significant adoption, particularly within the e-commerce sector, as businesses sought innovative ways to overcome the limitations of traditional online shopping. The estimated year 2025 signifies a pivotal moment, representing a substantial increase in market penetration and a shift towards more sophisticated and immersive virtual fitting experiences. This is fueled by the growing preference for online shopping, the increasing demand for personalized experiences, and the desire to minimize returns. The market is segmented by type (cloud-based and web-based) and application (enterprises and individuals), each demonstrating unique growth trajectories. Cloud-based solutions are witnessing rapid adoption due to their scalability and accessibility, while web-based solutions offer convenience and ease of integration. Enterprise applications lead in terms of revenue, driven by the need for larger-scale integration and data analysis capabilities. The forecast period indicates continued robust growth, driven by technological advancements, increasing consumer demand, and expanding market penetration across various retail sectors. Millions of units are projected to be sold, demonstrating a clear trend toward the widespread adoption of virtual fitting tools across the globe. The market is also showing a shift towards more integrated and personalized solutions that combine data from various sources to deliver more accurate and tailored fitting experiences.

Driving Forces: What's Propelling the Virtual Fitting Tools Market?

Several key factors are driving the significant growth of the virtual fitting tools market. The increasing prevalence of e-commerce is a major catalyst, as online shoppers often struggle with sizing and fit uncertainties. Virtual fitting tools directly address this issue, offering a realistic preview of how garments will look and fit, thereby significantly reducing the risk of returns and enhancing the overall online shopping experience. The rising adoption of smartphones and other mobile devices equipped with advanced cameras and processing power enables better AR and 3D rendering capabilities, further improving the accuracy and realism of virtual try-ons. Technological advancements in AI and machine learning are instrumental in powering more accurate sizing algorithms and personalized recommendations, leading to a more customized and efficient shopping process. Moreover, the growing demand for personalized experiences is pushing retailers to adopt innovative technologies like virtual fitting tools to improve customer engagement and loyalty. The cost-effectiveness of reducing returns, a substantial expense for online retailers, further incentivizes investment in virtual fitting technologies. Finally, the expansion of high-speed internet access and increased digital literacy worldwide contribute to the broader adoption and accessibility of these tools. These combined factors point towards a consistently expanding market for virtual fitting tools in the coming years.

Challenges and Restraints in Virtual Fitting Tools

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of virtual fitting tools. The accuracy of virtual fitting remains a key concern; discrepancies between virtual and physical fitting experiences can lead to dissatisfaction and returns. Achieving realistic simulations of garment drape and texture on different body types presents a persistent technological hurdle. High initial investment costs for both software and hardware can be a barrier to entry for smaller businesses, limiting their participation in the market. The need for high-quality 3D models and accurate body scans can be time-consuming and expensive, impacting the efficiency of implementation. Integrating virtual fitting tools seamlessly into existing e-commerce platforms can pose technical challenges and require significant development effort. Moreover, consumer skepticism and a lack of awareness regarding the reliability and accuracy of these tools can hinder adoption. Addressing these challenges through technological innovation, improved user interfaces, and targeted marketing campaigns is crucial for realizing the full potential of the virtual fitting tools market.

Key Region or Country & Segment to Dominate the Market

The global market for virtual fitting tools shows robust growth across various regions, but certain segments and geographic locations are expected to dominate.

Dominant Segments:

Cloud-Based Solutions: The scalability, accessibility, and cost-effectiveness of cloud-based solutions make them highly attractive to businesses of all sizes. This segment is projected to experience significant growth throughout the forecast period (2025-2033), driven by the increasing demand for flexible and readily deployable virtual fitting solutions. The ease of integration with existing e-commerce platforms also contributes to its dominance.

Enterprise Applications: Large businesses with substantial online presence and significant investment capacity are leading the adoption of virtual fitting tools. Enterprise solutions allow for large-scale deployment, data analytics, and integration with existing CRM and ERP systems, resulting in improved efficiency and customer experience management.

Dominant Regions/Countries:

North America: The early adoption of e-commerce and a high level of technological advancement have positioned North America as a leading market for virtual fitting tools. The region’s well-established e-commerce infrastructure, high internet penetration rates, and technologically savvy consumer base contribute to its dominance.

Europe: With a large and growing online retail sector, Europe is also experiencing significant growth in the adoption of virtual fitting tools. Factors driving this growth include the increasing penetration of high-speed internet and the rising demand for convenient and personalized online shopping experiences.

Asia-Pacific: The rapid growth of e-commerce and the increasing penetration of smartphones in the Asia-Pacific region are creating significant opportunities for the virtual fitting tools market. However, challenges remain, such as varying levels of digital literacy and internet infrastructure across different countries within the region.

In summary, the combination of cloud-based solutions and enterprise applications across North America and Europe is poised to dominate the market, reflecting the early adoption of technology, advanced e-commerce infrastructure, and high consumer demand for enhanced online shopping experiences. The Asia-Pacific region presents significant future potential but faces challenges related to infrastructure and digital literacy.

Growth Catalysts in Virtual Fitting Tools Industry

The virtual fitting tools industry is experiencing rapid expansion driven by several key factors. The ongoing shift towards online shopping and the increasing demand for personalized experiences are major catalysts, pushing retailers to adopt innovative solutions to improve customer engagement and reduce returns. Continuous technological advancements, particularly in AR, AI, and 3D modeling, are also crucial, enabling more realistic and accurate virtual fitting experiences. The cost-effectiveness of reducing returns, a significant expense for e-commerce businesses, further incentivizes investment in these technologies. The expanding global adoption of smartphones and high-speed internet also plays a role in increased market accessibility and consumer adoption. These factors collectively contribute to the rapid and sustained growth of the virtual fitting tools market.

Leading Players in the Virtual Fitting Tools Market

- Fitanalytics

- Fitizzy

- Fitle

- Secret Sauce Partners

- Metail

- ShoeSize.me

- Sizebay

- Sizolution

- True Fit Corporation

- Virtusize

- Zugara

Significant Developments in Virtual Fitting Tools Sector

- 2020: Several key players launched updated platforms with improved AR and AI capabilities.

- 2021: Increased partnerships between virtual fitting tool providers and major e-commerce platforms were observed.

- 2022: Focus shifted towards integration with mobile applications and personalized recommendation engines.

- 2023: Several companies announced investments in research and development for more realistic fabric simulation.

- 2024: The market witnessed increased adoption of cloud-based solutions, driven by scalability and cost-effectiveness.

Comprehensive Coverage Virtual Fitting Tools Report

This report provides a comprehensive analysis of the virtual fitting tools market, encompassing historical data, current market trends, future projections, and key market drivers. It offers a detailed segmentation of the market by type, application, and geography, providing valuable insights into the dynamics and opportunities within each segment. The report also profiles leading players in the market, highlighting their strategies, market share, and recent developments. This in-depth analysis is intended to guide businesses and investors in making informed decisions regarding their involvement in the rapidly evolving virtual fitting tools market. The report’s projection of multi-million unit sales within the forecast period underscores the immense growth potential of this sector.

Virtual Fitting Tools Segmentation

-

1. Type

- 1.1. Cloud-Based

- 1.2. Web-Based

-

2. Application

- 2.1. Enterprises

- 2.2. Individuals

Virtual Fitting Tools Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Virtual Fitting Tools REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtual Fitting Tools Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cloud-Based

- 5.1.2. Web-Based

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Enterprises

- 5.2.2. Individuals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Virtual Fitting Tools Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cloud-Based

- 6.1.2. Web-Based

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Enterprises

- 6.2.2. Individuals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Virtual Fitting Tools Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cloud-Based

- 7.1.2. Web-Based

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Enterprises

- 7.2.2. Individuals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Virtual Fitting Tools Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cloud-Based

- 8.1.2. Web-Based

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Enterprises

- 8.2.2. Individuals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Virtual Fitting Tools Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cloud-Based

- 9.1.2. Web-Based

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Enterprises

- 9.2.2. Individuals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Virtual Fitting Tools Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cloud-Based

- 10.1.2. Web-Based

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Enterprises

- 10.2.2. Individuals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fitanalytics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fitizzy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fitle

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Secret Sauce Partners

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Metail

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ShoeSize.me

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sizebay

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sizolution

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 True Fit Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virtusize

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zugara

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Fitanalytics

- Figure 1: Global Virtual Fitting Tools Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Virtual Fitting Tools Revenue (million), by Type 2024 & 2032

- Figure 3: North America Virtual Fitting Tools Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Virtual Fitting Tools Revenue (million), by Application 2024 & 2032

- Figure 5: North America Virtual Fitting Tools Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Virtual Fitting Tools Revenue (million), by Country 2024 & 2032

- Figure 7: North America Virtual Fitting Tools Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Virtual Fitting Tools Revenue (million), by Type 2024 & 2032

- Figure 9: South America Virtual Fitting Tools Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Virtual Fitting Tools Revenue (million), by Application 2024 & 2032

- Figure 11: South America Virtual Fitting Tools Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Virtual Fitting Tools Revenue (million), by Country 2024 & 2032

- Figure 13: South America Virtual Fitting Tools Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Virtual Fitting Tools Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Virtual Fitting Tools Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Virtual Fitting Tools Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Virtual Fitting Tools Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Virtual Fitting Tools Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Virtual Fitting Tools Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Virtual Fitting Tools Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Virtual Fitting Tools Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Virtual Fitting Tools Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Virtual Fitting Tools Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Virtual Fitting Tools Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Virtual Fitting Tools Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Virtual Fitting Tools Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Virtual Fitting Tools Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Virtual Fitting Tools Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Virtual Fitting Tools Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Virtual Fitting Tools Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Virtual Fitting Tools Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Virtual Fitting Tools Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Virtual Fitting Tools Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Virtual Fitting Tools Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Virtual Fitting Tools Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Virtual Fitting Tools Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Virtual Fitting Tools Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Virtual Fitting Tools Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Virtual Fitting Tools Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Virtual Fitting Tools Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Virtual Fitting Tools Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Virtual Fitting Tools Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Virtual Fitting Tools Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Virtual Fitting Tools Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Virtual Fitting Tools Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Virtual Fitting Tools Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Virtual Fitting Tools Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Virtual Fitting Tools Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Virtual Fitting Tools Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Virtual Fitting Tools Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Virtual Fitting Tools Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.