Warehouse and Logistic Automation

Warehouse and Logistic AutomationWarehouse and Logistic Automation Is Set To Reach XXX million By 2033, Growing At A CAGR Of XX

Warehouse and Logistic Automation by Type (Hardware, Software, Integrated System), by Application (E-Commerce, Lithium Battery, Food And Drink, Pharmaceutical, Automotive, Photovoltaic, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The warehouse and logistics automation market is experiencing robust growth, driven by the escalating demand for efficient supply chain management and e-commerce expansion. The market, estimated at $80 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This growth is fueled by several key factors, including the increasing adoption of automated guided vehicles (AGVs), robotic process automation (RPA), and warehouse management systems (WMS) to optimize warehouse operations. Furthermore, the rising labor costs and the need for improved order fulfillment speed are compelling businesses across various sectors—including e-commerce, pharmaceuticals, and automotive—to invest heavily in automation technologies. The integration of artificial intelligence (AI) and machine learning (ML) into warehouse automation is further accelerating innovation and efficiency gains. While initial investment costs can be significant, the long-term return on investment (ROI) from reduced operational expenses, enhanced accuracy, and improved throughput makes automation a compelling proposition for businesses of all sizes.

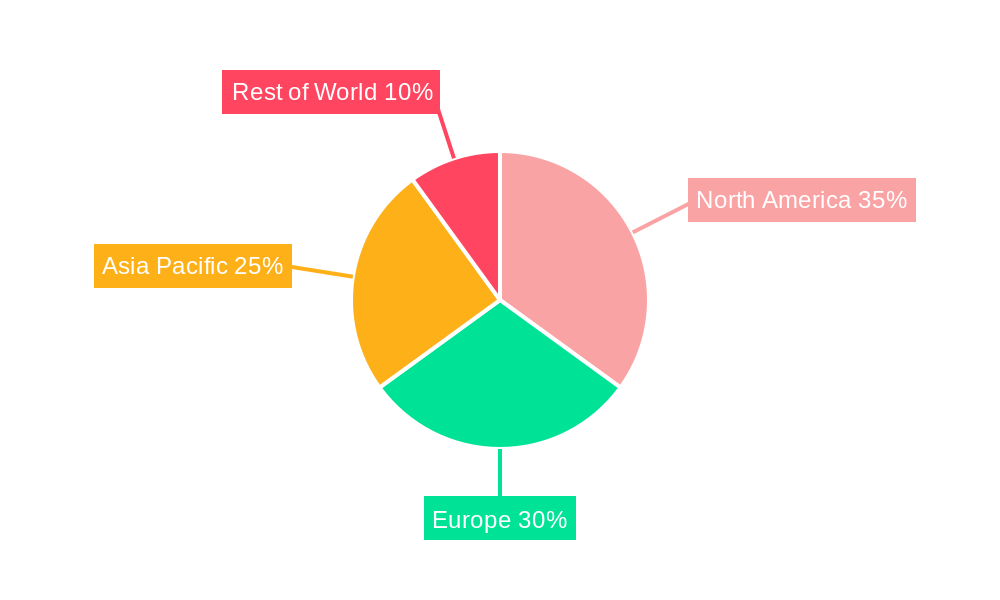

The market segmentation reveals a diverse landscape. Hardware solutions, including AGVs, conveyor systems, and sorting systems, currently dominate the market share, but software solutions and integrated systems are rapidly gaining traction due to their scalability and flexibility. E-commerce remains a significant application driver, but the increasing automation needs of other sectors, such as pharmaceuticals (requiring stringent quality control and traceability), and the automotive industry (with its complex logistics needs), are contributing to the overall market expansion. Geographically, North America and Europe currently hold the largest market shares, benefiting from advanced infrastructure and strong technological adoption rates. However, the Asia-Pacific region, particularly China and India, is exhibiting impressive growth potential driven by rapid industrialization and expanding e-commerce markets. Challenges remain, including the high initial investment costs, the need for skilled labor to operate and maintain automated systems, and concerns regarding data security. However, the long-term benefits of improved efficiency, reduced operational costs, and enhanced customer satisfaction are expected to outweigh these challenges, ensuring continued market expansion throughout the forecast period.

Warehouse and Logistic Automation Trends

The global warehouse and logistics automation market is experiencing explosive growth, projected to reach several hundred billion USD by 2033. The period from 2019 to 2024 witnessed significant market expansion driven by the e-commerce boom and the increasing need for efficient supply chain management. This trend is expected to continue throughout the forecast period (2025-2033), fueled by advancements in robotics, artificial intelligence (AI), and the Internet of Things (IoT). The market is characterized by a shift towards integrated systems, offering comprehensive solutions that combine hardware, software, and services. This integrated approach allows companies to optimize their entire warehouse operations, leading to significant improvements in efficiency, productivity, and cost savings. The demand for automation is particularly strong in sectors with high order volumes and stringent quality control requirements, such as e-commerce, pharmaceuticals, and automotive. Furthermore, the increasing adoption of automation in emerging economies is further boosting market growth. While the base year (2025) shows a robust market size in the tens of billions of USD, the estimated year (2025) projections reflect a substantial increase fueled by continued investments in automation technologies and the growing adoption across various industries. The historical period (2019-2024) laid the groundwork for this rapid expansion, setting the stage for the market's impressive future trajectory. This report will delve deeper into specific market segments and key players to further illuminate these trends and their implications.

Driving Forces: What's Propelling the Warehouse and Logistic Automation

Several key factors are driving the rapid expansion of the warehouse and logistics automation market. Firstly, the unrelenting growth of e-commerce is demanding faster delivery times and increased order fulfillment capacity. Automation offers the speed and precision necessary to meet these escalating demands. Secondly, labor shortages and rising labor costs are pushing businesses to automate tasks previously handled manually. Automated systems can operate 24/7, increasing productivity and reducing reliance on human workers. Thirdly, the ongoing advancements in technology, such as AI-powered robotics, sophisticated warehouse management systems (WMS), and improved data analytics, are making automation solutions more efficient, affordable, and user-friendly. These advancements are not only improving operational efficiency but also driving down the overall cost of implementation. Finally, the growing emphasis on supply chain resilience and optimization is compelling companies to invest in automation to improve their overall supply chain visibility and responsiveness to disruptions. This includes predictive maintenance capabilities, real-time tracking, and enhanced inventory management, all contributing to a more robust and efficient supply chain.

Challenges and Restraints in Warehouse and Logistic Automation

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of warehouse and logistics automation. High initial investment costs for implementing automated systems can be a significant barrier for smaller businesses. The complexity of integrating new automated systems into existing warehouse infrastructure can also present considerable challenges. Furthermore, the need for skilled labor to operate and maintain these systems adds to the overall cost and complexity. Concerns regarding job displacement due to automation are also a factor, requiring careful consideration of workforce retraining and adaptation strategies. Cybersecurity risks associated with connected automated systems are another major concern, necessitating robust security measures. Finally, the lack of standardization and interoperability among different automation systems can create integration difficulties and limit the potential benefits of automation. Addressing these challenges is crucial for unlocking the full potential of warehouse and logistics automation and ensuring its sustainable growth.

Key Region or Country & Segment to Dominate the Market

The North American and European markets currently dominate the warehouse and logistics automation market, driven by high levels of technological adoption and significant investments in automation solutions. However, the Asia-Pacific region is experiencing rapid growth, fueled by the expansion of e-commerce and manufacturing industries in countries like China and India.

Dominant Segments: The integrated systems segment is expected to hold a significant market share due to its ability to provide comprehensive solutions that optimize entire warehouse operations. Within applications, the e-commerce segment shows the fastest growth owing to the explosive growth in online retail. The pharmaceutical sector is also a major driver of automation adoption due to stringent regulatory requirements and the need for precise inventory management.

Growth in Specific Regions: North America’s established e-commerce infrastructure and high adoption rates are driving growth. In Europe, countries like Germany and the UK represent significant market segments due to robust logistics networks. The Asia-Pacific region is experiencing substantial growth, with China leading the way, boosted by its large manufacturing sector and fast-growing e-commerce market.

Hardware Segment Analysis: Within the hardware segment, automated guided vehicles (AGVs), automated storage and retrieval systems (AS/RS), and conveyor systems are experiencing robust demand. The need for efficient material handling across various industries is driving this segment's growth.

Software Segment Analysis: Software solutions, including warehouse management systems (WMS), transportation management systems (TMS), and inventory management software, are essential for optimizing warehouse operations. The integration of AI and machine learning into these systems is enhancing efficiency and predictive capabilities.

The significant investments in warehouse automation solutions in these regions and segments indicate the strong potential for sustained growth in the foreseeable future, with projections indicating several billion USD in annual revenue by the end of the forecast period.

Growth Catalysts in Warehouse and Logistic Automation Industry

Several factors are catalyzing growth in the warehouse and logistics automation industry. The ongoing advancements in robotics, AI, and IoT are continuously improving the efficiency, affordability, and capabilities of automation technologies. Government initiatives and incentives promoting automation are further encouraging adoption. The increasing pressure to optimize supply chain efficiency and reduce operational costs is motivating companies to invest in automation solutions. The rise of Industry 4.0 and the digital transformation of logistics are creating new opportunities for innovation and growth in the sector.

Leading Players in the Warehouse and Logistic Automation

- DAIFUKU

- Dematic

- SCHAEFER

- Honeywell

- Vanderlande

- Knapp

- Muratec

- NHS

- WITRON Integrated Logistics

- Mecalux

- Beumer Group

- Siemens

- TGW

- Swisslog

- Fives Group

- Kardex

- Elettric 80

- Noblelift Intelligent Equipment

- Wayzim Technology

- KSEC Intelligent Technology

- New Trend International Logis-tec

- Damon Technology Group

- Dongjie Intelligent (Shenzhen)

Significant Developments in Warehouse and Logistic Automation Sector

- 2020: Increased adoption of robotic process automation (RPA) in warehouse operations.

- 2021: Significant advancements in AI-powered warehouse management systems.

- 2022: Growth in the use of autonomous mobile robots (AMRs) for material handling.

- 2023: Increased investment in cloud-based warehouse management solutions.

- 2024: Expansion of the use of Internet of Things (IoT) sensors for real-time inventory tracking.

Comprehensive Coverage Warehouse and Logistic Automation Report

This report provides a comprehensive overview of the warehouse and logistics automation market, offering detailed analysis of market trends, drivers, challenges, key players, and future growth prospects. It covers key segments, regions, and technologies, providing valuable insights for businesses seeking to leverage automation to enhance their supply chain efficiency and competitiveness. The detailed projections presented provide a strong foundation for strategic decision-making in this rapidly evolving sector.

Warehouse and Logistic Automation Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Integrated System

-

2. Application

- 2.1. E-Commerce

- 2.2. Lithium Battery

- 2.3. Food And Drink

- 2.4. Pharmaceutical

- 2.5. Automotive

- 2.6. Photovoltaic

- 2.7. Other

Warehouse and Logistic Automation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Warehouse and Logistic Automation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

What are the main segments of the Warehouse and Logistic Automation?

The market segments include

Are there any restraints impacting market growth?

.

Which companies are prominent players in the Warehouse and Logistic Automation?

Key companies in the market include DAIFUKU,Dematic,SCHAEFER,Honeywell,Vanderlande,Knapp,Muratec,NHS,WITRON Integrated Logistics,Mecalux,Beumer Group,Siemens,TGW,Swisslog,Fives Group,Kardex,Elettric 80,Noblelift Intelligent Equipment,Wayzim Technology,KSEC Intelligent Technology,New Trend International Logis-tec,Damon Technology Group,Dongjie Intelligent (Shenzhen),

What is the projected Compound Annual Growth Rate (CAGR) of the Warehouse and Logistic Automation ?

The projected CAGR is approximately XX%.

How can I stay updated on further developments or reports in the Warehouse and Logistic Automation?

To stay informed about further developments, trends, and reports in the Warehouse and Logistic Automation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

What are some drivers contributing to market growth?

.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Warehouse and Logistic Automation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Integrated System

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. E-Commerce

- 5.2.2. Lithium Battery

- 5.2.3. Food And Drink

- 5.2.4. Pharmaceutical

- 5.2.5. Automotive

- 5.2.6. Photovoltaic

- 5.2.7. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Warehouse and Logistic Automation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Integrated System

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. E-Commerce

- 6.2.2. Lithium Battery

- 6.2.3. Food And Drink

- 6.2.4. Pharmaceutical

- 6.2.5. Automotive

- 6.2.6. Photovoltaic

- 6.2.7. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Warehouse and Logistic Automation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Integrated System

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. E-Commerce

- 7.2.2. Lithium Battery

- 7.2.3. Food And Drink

- 7.2.4. Pharmaceutical

- 7.2.5. Automotive

- 7.2.6. Photovoltaic

- 7.2.7. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Warehouse and Logistic Automation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Integrated System

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. E-Commerce

- 8.2.2. Lithium Battery

- 8.2.3. Food And Drink

- 8.2.4. Pharmaceutical

- 8.2.5. Automotive

- 8.2.6. Photovoltaic

- 8.2.7. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Warehouse and Logistic Automation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Integrated System

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. E-Commerce

- 9.2.2. Lithium Battery

- 9.2.3. Food And Drink

- 9.2.4. Pharmaceutical

- 9.2.5. Automotive

- 9.2.6. Photovoltaic

- 9.2.7. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Warehouse and Logistic Automation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Integrated System

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. E-Commerce

- 10.2.2. Lithium Battery

- 10.2.3. Food And Drink

- 10.2.4. Pharmaceutical

- 10.2.5. Automotive

- 10.2.6. Photovoltaic

- 10.2.7. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DAIFUKU

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dematic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SCHAEFER

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vanderlande

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Knapp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Muratec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NHS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 WITRON Integrated Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mecalux

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Beumer Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Siemens

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TGW

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Swisslog

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Fives Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Kardex

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Elettric 80

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Noblelift Intelligent Equipment

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Wayzim Technology

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 KSEC Intelligent Technology

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 New Trend International Logis-tec

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Damon Technology Group

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Dongjie Intelligent (Shenzhen)

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 DAIFUKU

- Figure 1: Global Warehouse and Logistic Automation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Warehouse and Logistic Automation Revenue (million), by Type 2024 & 2032

- Figure 3: North America Warehouse and Logistic Automation Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Warehouse and Logistic Automation Revenue (million), by Application 2024 & 2032

- Figure 5: North America Warehouse and Logistic Automation Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Warehouse and Logistic Automation Revenue (million), by Country 2024 & 2032

- Figure 7: North America Warehouse and Logistic Automation Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Warehouse and Logistic Automation Revenue (million), by Type 2024 & 2032

- Figure 9: South America Warehouse and Logistic Automation Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Warehouse and Logistic Automation Revenue (million), by Application 2024 & 2032

- Figure 11: South America Warehouse and Logistic Automation Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Warehouse and Logistic Automation Revenue (million), by Country 2024 & 2032

- Figure 13: South America Warehouse and Logistic Automation Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Warehouse and Logistic Automation Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Warehouse and Logistic Automation Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Warehouse and Logistic Automation Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Warehouse and Logistic Automation Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Warehouse and Logistic Automation Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Warehouse and Logistic Automation Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Warehouse and Logistic Automation Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Warehouse and Logistic Automation Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Warehouse and Logistic Automation Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Warehouse and Logistic Automation Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Warehouse and Logistic Automation Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Warehouse and Logistic Automation Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Warehouse and Logistic Automation Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Warehouse and Logistic Automation Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Warehouse and Logistic Automation Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Warehouse and Logistic Automation Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Warehouse and Logistic Automation Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Warehouse and Logistic Automation Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Warehouse and Logistic Automation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Warehouse and Logistic Automation Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Warehouse and Logistic Automation Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Warehouse and Logistic Automation Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Warehouse and Logistic Automation Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Warehouse and Logistic Automation Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Warehouse and Logistic Automation Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Warehouse and Logistic Automation Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Warehouse and Logistic Automation Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Warehouse and Logistic Automation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Warehouse and Logistic Automation Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Warehouse and Logistic Automation Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Warehouse and Logistic Automation Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Warehouse and Logistic Automation Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Warehouse and Logistic Automation Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Warehouse and Logistic Automation Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Warehouse and Logistic Automation Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Warehouse and Logistic Automation Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Warehouse and Logistic Automation Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Warehouse and Logistic Automation Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.