X-Ray Detector Software

X-Ray Detector SoftwareX-Ray Detector Software 2025-2033 Trends: Unveiling Growth Opportunities and Competitor Dynamics

X-Ray Detector Software by Type (Information Collection Software, Information Management Software, Diagnostic Software), by Application (Hospital, Clinic, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

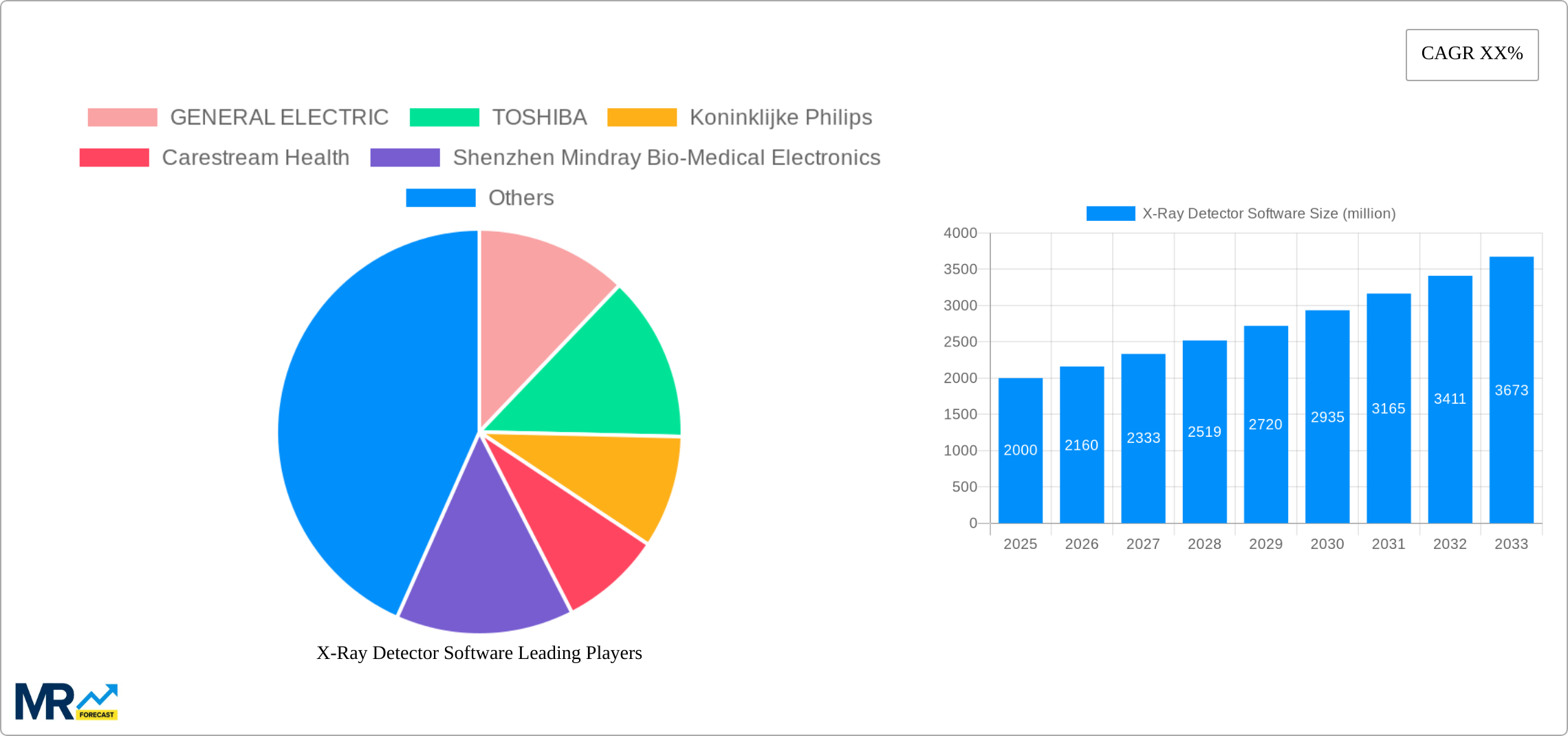

The X-ray detector software market is experiencing robust growth, driven by the increasing adoption of digital X-ray systems in healthcare settings and the rising demand for advanced image processing and analysis capabilities. The market is segmented by software type (Information Collection, Management, and Diagnostic) and application (Hospital, Clinic, and Other). While precise market sizing data is absent, considering the presence of major players like GE, Toshiba, and Philips, along with a multitude of smaller specialized firms, a conservative estimate places the 2025 market value at approximately $2 billion. A Compound Annual Growth Rate (CAGR) of 8% is reasonable, considering technological advancements and growing healthcare spending globally. This suggests a market size exceeding $3 billion by 2033. Key drivers include the need for improved diagnostic accuracy, enhanced workflow efficiency in radiology departments, and the increasing prevalence of chronic diseases requiring frequent X-ray examinations. Trends point toward the integration of AI and machine learning for automated image analysis, cloud-based solutions for improved data management and accessibility, and the development of specialized software for specific applications like dental or veterinary radiology. Restraints include high initial investment costs for software and hardware, concerns about data security and privacy, and the need for specialized training for healthcare professionals to effectively utilize advanced software features. The North American market currently holds a significant share due to high healthcare expenditure and technological advancements, but the Asia-Pacific region is projected to witness the fastest growth due to increasing healthcare infrastructure development and rising disposable incomes.

The competitive landscape is characterized by the presence of both established medical technology giants and specialized software developers. Larger companies leverage their existing market presence and distribution networks to maintain a leading position. Smaller firms often focus on niche applications or innovative software features to gain a competitive edge. Strategic partnerships and acquisitions are anticipated to further shape the market landscape in the coming years. Future growth will hinge on the continued development of sophisticated algorithms for improved image quality and diagnostic accuracy, integration with other medical imaging modalities, and the establishment of robust cybersecurity measures to address data protection concerns. The successful navigation of regulatory hurdles and the efficient dissemination of training resources will also play crucial roles in market expansion.

X-Ray Detector Software Trends

The global X-ray detector software market is experiencing robust growth, projected to reach several billion USD by 2033. Driven by technological advancements, increasing healthcare expenditure, and a rising prevalence of chronic diseases requiring advanced diagnostic imaging, the market is witnessing a significant shift towards sophisticated software solutions. The historical period (2019-2024) saw a steady rise in adoption, particularly in developed nations. However, the forecast period (2025-2033) anticipates even more explosive growth, fueled by the expansion of digital healthcare infrastructure, the integration of artificial intelligence (AI) in image analysis, and the increasing demand for cloud-based solutions for improved data management and accessibility. The estimated market value for 2025 stands at over USD 1.5 billion, highlighting the substantial investment and market potential. This growth is further bolstered by the rising adoption of advanced imaging modalities in developing countries, leading to increased demand for software capable of handling the growing volume of image data. Key players are strategically investing in research and development to enhance software functionalities, offering solutions ranging from basic image processing to sophisticated AI-powered diagnostic tools, which are significantly impacting the market dynamics. The market is also witnessing the rise of specialized software tailored for specific clinical applications, further segmenting the market and providing unique opportunities for specialized vendors.

Driving Forces: What's Propelling the X-Ray Detector Software Market?

Several factors are converging to propel the expansion of the X-ray detector software market. The increasing prevalence of chronic diseases, such as cancer, cardiovascular diseases, and musculoskeletal disorders, necessitates advanced diagnostic imaging techniques, creating a substantial demand for efficient and accurate software for image analysis and interpretation. Technological advancements, particularly in AI and machine learning, are significantly enhancing the capabilities of X-ray detector software, enabling faster and more accurate diagnosis, and improved workflow efficiency. Furthermore, the rising adoption of digital healthcare infrastructure, including electronic health records (EHR) and picture archiving and communication systems (PACS), is creating a favorable environment for the integration of X-ray detector software. This integration streamlines data management, enhances interoperability between healthcare systems, and improves overall patient care. Government initiatives aimed at promoting digital health and improving healthcare infrastructure in many regions are also contributing significantly to market growth. Finally, the increasing demand for cost-effective and efficient healthcare solutions is driving the adoption of advanced X-ray detector software, as they improve diagnostic accuracy, reduce operational costs, and optimize workflow efficiency.

Challenges and Restraints in X-Ray Detector Software

Despite the promising growth outlook, several challenges hinder the widespread adoption of X-ray detector software. High initial investment costs associated with the purchase and implementation of advanced software can pose a significant barrier, especially for smaller clinics and healthcare facilities with limited budgets. The complexity of the software and the need for specialized training for healthcare professionals can also hinder wider adoption. Data security and privacy concerns are paramount in the healthcare sector, and ensuring the robust security of patient data handled by X-ray detector software is crucial for compliance with regulations and maintaining patient trust. Moreover, the need for continuous software updates and maintenance can add to the ongoing operational costs, potentially deterring some healthcare facilities. Finally, the integration of different X-ray detector software systems with existing hospital information systems (HIS) and other medical devices can be complex, requiring significant technical expertise and potentially leading to compatibility issues. Overcoming these challenges requires collaborative efforts between software developers, healthcare providers, and regulatory bodies.

Key Region or Country & Segment to Dominate the Market

The Hospital application segment is expected to dominate the X-ray detector software market throughout the forecast period (2025-2033). Hospitals represent the largest consumer of advanced imaging technologies, and the need for sophisticated software for image analysis, management, and diagnostic support is paramount in these settings.

- High Volume of Patients: Hospitals handle a significantly larger volume of patients compared to clinics, leading to a greater demand for efficient and robust X-ray detector software.

- Advanced Diagnostic Capabilities: Hospitals often have more advanced diagnostic equipment and require software capable of handling complex imaging data and integrating with various other systems.

- Specialized Departments: The presence of various specialized departments within hospitals, such as radiology, cardiology, and oncology, creates a diversified need for X-ray detector software with specific features catering to these areas.

- Investment Capacity: Hospitals generally have greater financial resources compared to smaller clinics, allowing them to invest in advanced X-ray detector software and related infrastructure.

- Research and Development: Hospitals often participate in research and development activities related to medical imaging, creating a demand for software capable of supporting these efforts.

North America and Europe are anticipated to hold significant market share, primarily due to well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and a strong presence of key players in these regions. However, the Asia-Pacific region is experiencing rapid growth due to increasing healthcare expenditure, expanding healthcare infrastructure, and a rising prevalence of chronic diseases. This region presents a considerable opportunity for X-ray detector software vendors in the coming years. The Diagnostic Software segment will also witness significant growth, reflecting the increasing focus on AI-powered diagnostic tools that automate image analysis and improve diagnostic accuracy.

Growth Catalysts in X-Ray Detector Software Industry

The X-ray detector software industry's growth is fueled by the convergence of several key factors. Advancements in artificial intelligence (AI) and machine learning are enabling more accurate and efficient image analysis, leading to faster diagnoses and improved patient outcomes. Increased government investments in healthcare infrastructure and digital health initiatives are creating a favorable environment for the adoption of advanced software solutions. The rising prevalence of chronic diseases, necessitating advanced diagnostic imaging, is further driving market growth. Finally, the growing demand for cloud-based solutions for improved data management and accessibility is also contributing to the expanding market.

Leading Players in the X-Ray Detector Software Market

- GENERAL ELECTRIC

- TOSHIBA

- Koninklijke Philips

- Carestream Health

- Shenzhen Mindray Bio-Medical Electronics

- Ziehm Imaging GmbH

- Canon

- FUJIFILM Holdings

- GMM PFAUDLER

- Danaher

- PLANMECA OY

- VATECH

- Villa Sistemi Medicali Spa

- Midmark Corporation

- Apteryx Imaging Inc

- Varian Medical Systems

- Hamamatsu Photonics

- KA Imaging

Significant Developments in X-Ray Detector Software Sector

- 2020: Several key players announced partnerships to integrate AI-powered diagnostic tools into their X-ray detector software platforms.

- 2021: New regulations regarding data security and privacy in medical imaging were implemented in several countries, impacting software development and deployment.

- 2022: Several companies released new software versions with enhanced functionalities, including improved image processing algorithms and cloud-based data management.

- 2023: Increased focus on the development of software specifically designed for mobile X-ray systems.

- 2024: Significant investments in research and development for AI-powered diagnostic tools within X-ray detector software.

Comprehensive Coverage X-Ray Detector Software Report

This report provides a comprehensive overview of the X-ray detector software market, analyzing key trends, driving forces, challenges, and growth opportunities. The report includes detailed market segmentation by type (Information Collection Software, Information Management Software, Diagnostic Software), application (Hospital, Clinic, Other), and geography. It also provides detailed profiles of leading players in the market, highlighting their competitive strategies and market share. The report offers valuable insights for stakeholders, including manufacturers, distributors, healthcare providers, and investors, seeking to understand the dynamics of this rapidly evolving market and make informed business decisions.

X-Ray Detector Software Segmentation

-

1. Type

- 1.1. Information Collection Software

- 1.2. Information Management Software

- 1.3. Diagnostic Software

-

2. Application

- 2.1. Hospital

- 2.2. Clinic

- 2.3. Other

X-Ray Detector Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

X-Ray Detector Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Are there any restraints impacting market growth?

.

What is the projected Compound Annual Growth Rate (CAGR) of the X-Ray Detector Software ?

The projected CAGR is approximately XX%.

What are some drivers contributing to market growth?

.

Which companies are prominent players in the X-Ray Detector Software?

Key companies in the market include GENERAL ELECTRIC,TOSHIBA,Koninklijke Philips,Carestream Health,Shenzhen Mindray Bio-Medical Electronics,Ziehm Imaging GmbH,Canon,FUJIFILM Holdings,GMM PFAUDLER,Danaher,PLANMECA OY,VATECH,Villa Sistemi Medicali Spa,Midmark Corporation,Apteryx Imaging Inc,Varian Medical Systems,Hamamatsu Photonics,KA Imaging,

What are the notable trends driving market growth?

.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

Can you provide examples of recent developments in the market?

undefined

How can I stay updated on further developments or reports in the X-Ray Detector Software?

To stay informed about further developments, trends, and reports in the X-Ray Detector Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global X-Ray Detector Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Information Collection Software

- 5.1.2. Information Management Software

- 5.1.3. Diagnostic Software

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Hospital

- 5.2.2. Clinic

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America X-Ray Detector Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Information Collection Software

- 6.1.2. Information Management Software

- 6.1.3. Diagnostic Software

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Hospital

- 6.2.2. Clinic

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America X-Ray Detector Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Information Collection Software

- 7.1.2. Information Management Software

- 7.1.3. Diagnostic Software

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Hospital

- 7.2.2. Clinic

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe X-Ray Detector Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Information Collection Software

- 8.1.2. Information Management Software

- 8.1.3. Diagnostic Software

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Hospital

- 8.2.2. Clinic

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa X-Ray Detector Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Information Collection Software

- 9.1.2. Information Management Software

- 9.1.3. Diagnostic Software

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Hospital

- 9.2.2. Clinic

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific X-Ray Detector Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Information Collection Software

- 10.1.2. Information Management Software

- 10.1.3. Diagnostic Software

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Hospital

- 10.2.2. Clinic

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GENERAL ELECTRIC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TOSHIBA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koninklijke Philips

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Carestream Health

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shenzhen Mindray Bio-Medical Electronics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ziehm Imaging GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Canon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FUJIFILM Holdings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GMM PFAUDLER

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Danaher

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PLANMECA OY

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 VATECH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Villa Sistemi Medicali Spa

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Midmark Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Apteryx Imaging Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Varian Medical Systems

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Hamamatsu Photonics

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 KA Imaging

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 GENERAL ELECTRIC

- Figure 1: Global X-Ray Detector Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America X-Ray Detector Software Revenue (million), by Type 2024 & 2032

- Figure 3: North America X-Ray Detector Software Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America X-Ray Detector Software Revenue (million), by Application 2024 & 2032

- Figure 5: North America X-Ray Detector Software Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America X-Ray Detector Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America X-Ray Detector Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America X-Ray Detector Software Revenue (million), by Type 2024 & 2032

- Figure 9: South America X-Ray Detector Software Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America X-Ray Detector Software Revenue (million), by Application 2024 & 2032

- Figure 11: South America X-Ray Detector Software Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America X-Ray Detector Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America X-Ray Detector Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe X-Ray Detector Software Revenue (million), by Type 2024 & 2032

- Figure 15: Europe X-Ray Detector Software Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe X-Ray Detector Software Revenue (million), by Application 2024 & 2032

- Figure 17: Europe X-Ray Detector Software Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe X-Ray Detector Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe X-Ray Detector Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa X-Ray Detector Software Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa X-Ray Detector Software Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa X-Ray Detector Software Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa X-Ray Detector Software Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa X-Ray Detector Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa X-Ray Detector Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific X-Ray Detector Software Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific X-Ray Detector Software Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific X-Ray Detector Software Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific X-Ray Detector Software Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific X-Ray Detector Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific X-Ray Detector Software Revenue Share (%), by Country 2024 & 2032

- Table 1: Global X-Ray Detector Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global X-Ray Detector Software Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global X-Ray Detector Software Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global X-Ray Detector Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global X-Ray Detector Software Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global X-Ray Detector Software Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global X-Ray Detector Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global X-Ray Detector Software Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global X-Ray Detector Software Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global X-Ray Detector Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global X-Ray Detector Software Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global X-Ray Detector Software Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global X-Ray Detector Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global X-Ray Detector Software Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global X-Ray Detector Software Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global X-Ray Detector Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global X-Ray Detector Software Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global X-Ray Detector Software Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global X-Ray Detector Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific X-Ray Detector Software Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.